The logistics sector plays a pivotal role in the nation’s economy – whether it is in the distribution of essential goods like medicines or household items ordered via an e-commerce website. In 2022, the Indian logistics sector was valued at $210 bn and is estimated to grow at a CAGR of 8-10% in the coming years. It is estimated that India spends around 14% of its GDP on logistics, second only to China and higher than the average of 7-8% spent by developed countries.

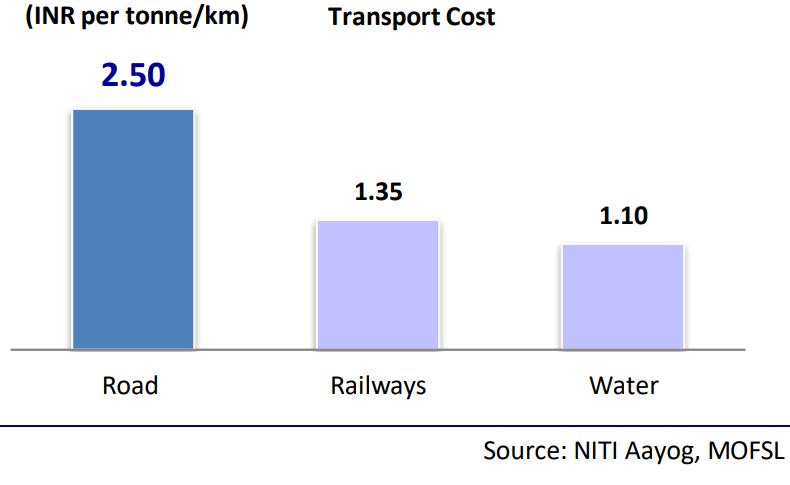

India’s logistics relies highly on roadways, despite being the costliest, as opposed to other modes like railways or waterways. Other developed nations have a much lower share of roadways in their model mix. If we look at the cost of different modes in India, road transport comes close to ~2x that of railways. To keep the logistics cost in check, there’s a need to reduce the dependence on roadways as a mode of goods transport.

The government intends to bring this cost down to 8% of GDP and improve its ranking in the Logistics Performance Index to 25 within the next five years. This would ensure that the logistics sector remains at the centre stage of government spending and emerges as a major factor in upgrading India to a $5 tn economy.

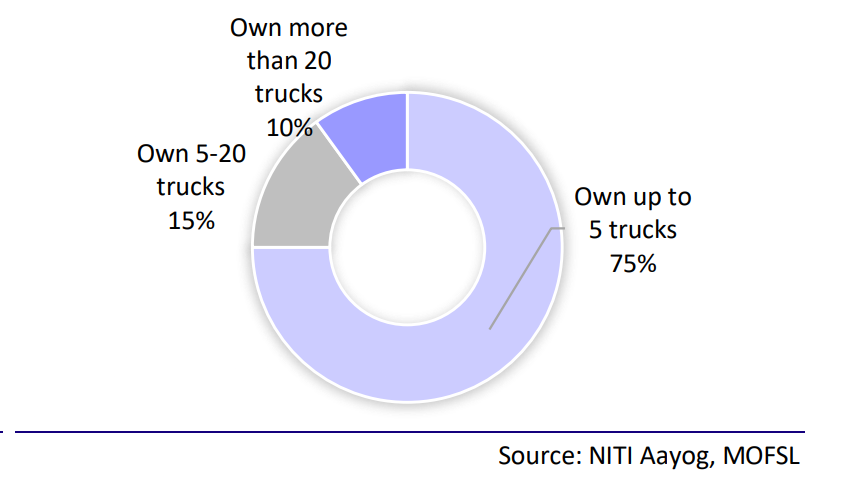

Additionally, the Indian logistics sector is largely dependent on unorganised players. Unorganised players consist of small players having less than five trucks. They often lack the resources to invest in the technological advancement of their fleet and operations. Hence, unorganised players and high dependency on roadways remain the major challenges the sector must solve in the coming years.

Trends which are supporting the growth of the logistics industry

- The National Logistics Policy (NLP) to guide the sector

The government has designed the National Logistics Policy 2022 (NLP) to reduce the logistics cost in India by 2030. The government plans to do this by developing a technologically-enabled, integrated, cost-efficient, and trusted logistics ecosystem.

A key highlight of the policy is the development of a Unified Logistics Interface Platform (ULIP) to bring all transportation digital services into a single platform. Currently, the communication between various logistics stakeholders is fragmented as most players are in the unorganised sector. Implementing ULIP helps manufacturers, governments, and shippers exchange information in real-time. This will help in reducing delays and transport costs and enhancing efficiency.

NLP, along with PM Gati Shakti (A national plan for multi-modal connectivity) and other reforms like GST, will prove to be a huge impetus to the development of the nation’s supply chain.

2. Rise of 3PL players due to increased demand

An increasing number of organisations are outsourcing their supply chain operations to logistics partners to minimise costs and focus on their core competencies. This trend will likely bring the supply chain operations from automobile, FMCG, pharmaceuticals, and retail to existing 3PL (third-party logistics) players in the sector.

Moreover, with the emergence of e-commerce, demand for goods and services is rising in tier-2 & 3 cities. Express logistics companies are looking to meet the needs of organisations which are serving this new wave of customers.

Additionally, online shopping, especially for groceries, has increased multifold since the pandemic. In fact, as per Statista, the market value of online groceries was Rs. 100 bn in 2019 and is expected to grow to Rs. 1,170 bn in 2024. The growth of e-commerce grocery players will also fuel the growth of last-mile logistics providers.

3. New-age tech operators

Like any other sector, logistics has also seen the emergence of new-age technology-oriented operators. These operators are increasingly using technology as a differentiating factor to solve the inefficiencies in the system. This phenomenon has also forced traditional operators to invest in developing newer technology, such as artificial intelligence and blockchain. The industry will likely benefit due to the improved efficiency and faster turnaround time.

What can be expected in the next 5 yrs?

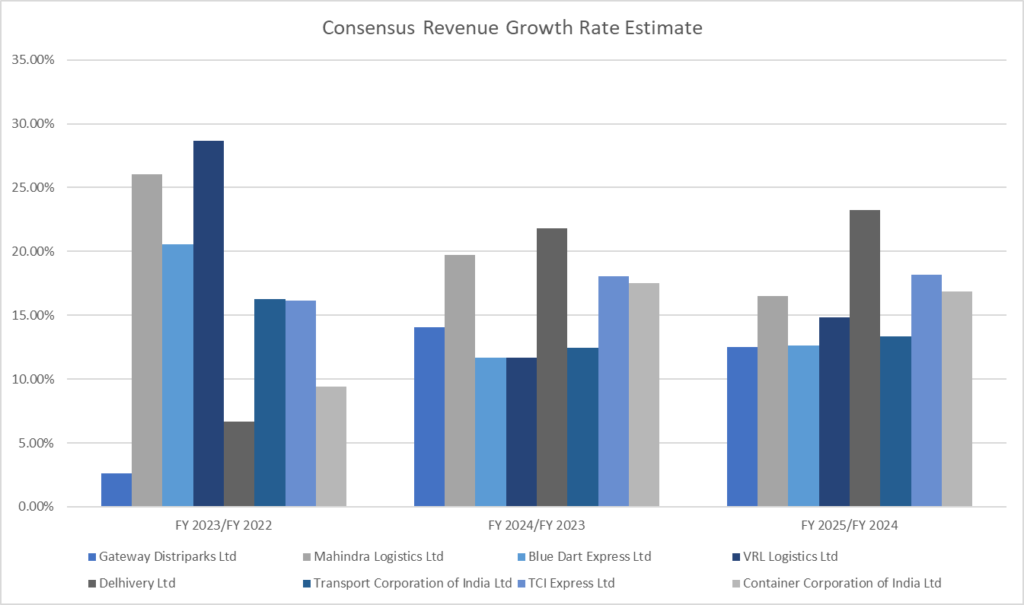

Industry experts expect the sector to reach the ~$380 bn mark by 2025. Most logistics companies are expected to have revenue growth upward of 10% for the next 3 yrs. Additionally, the adoption of sustainable transport, such as electric vehicles and alternative delivery methods like drones, may be expected in the coming years, provided they are available at reasonable costs.

All in all, it is hard to miss the role of logistics in the progress of the nation. It ensures that the consumers procure their goods on time from producers. Moreover, the logistics industry’s performance can also be linked with the health of the economic demand. Often operating volumes of logistics firms swell during economic prosperity and drop during economic downturns. So whenever you are wondering about the status of the economy, ensure to look into the status of the logistics sector, among other things, to gauge the situation.

Disclaimer: The content in this article is purely the author’s personal opinion and is for informational and educational purposes only. It should not be construed as professional financial advice and nor be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.

The views and opinions stated in the content belong to the author. Windmill Capital Private Limited does not uphold nor promote any of the views/opinions.

This article is written by Naveen of Windmill Capital. Click here to check Windmill Capital’s smallcases.

- Momentum Investing: How To Manage Risk? - Nov 6, 2023

- The Impact of Interest Rates on Real Estate Investments - Jul 19, 2023

- A Look into the Future of India’s Logistics Landscape - May 5, 2023