Last Updated on Jan 18, 2024 by Harshit Singh

As we usher in the new year, Netra’s latest edition is here to guide you through the evolving landscapes of investment and economics. This month, we delve into the transient surge in U.S. corporate profits, the sharp rebound in Indian corporate margins, investor sentiment towards Indian equities in FY24, and the Banking, Financial Services and Insurance (BFSI), and Healthcare sectors which are currently trading at average valuations, showing a continued improvement in financials despite underperforming compared to the broader small-cap universe in historical cycles.

We aim to equip you with comprehensive knowledge and insights, so you can stride into a new year with confidence.

Table of Contents

Is the record margin growth in U.S. corporate profits impressive or envy-inspiring?

The seemingly impressive surge in U.S. corporate profits has been a popular topic of discussion. The growth this season seems to be largely coming on the back of substantial government aid and an ultra-loose monetary policy in response to the COVID-19 pandemic. Note that the ‘covid years’ saw unprecedented government support such as the CARES Act that significantly reduced non-labor costs and boosted profit margins. Simultaneously, the Federal Reserve’s low interest rates further fueled this growth.

Post-pandemic, corporations significantly increased the prices of their products beyond the rises in labor and input costs, contributing to an expansion in profit margins and broader inflation trends. This has been perceived as a new era of enhanced corporate profitability, underpinned by narratives like ‘Big Becoming Bigger’. However, note that without government interventions, corporate profits during the pandemic would possibly have aligned with those seen in previous economic downturns.

As 2024 progresses, with the Federal Reserve reversing its policy and the Treasury expected to follow, corporate profit margins are poised to revert to more traditional levels. This anticipated shift suggests a return to profit margins that reflect historical norms, moving away from the inflated figures of the recent extraordinary period.

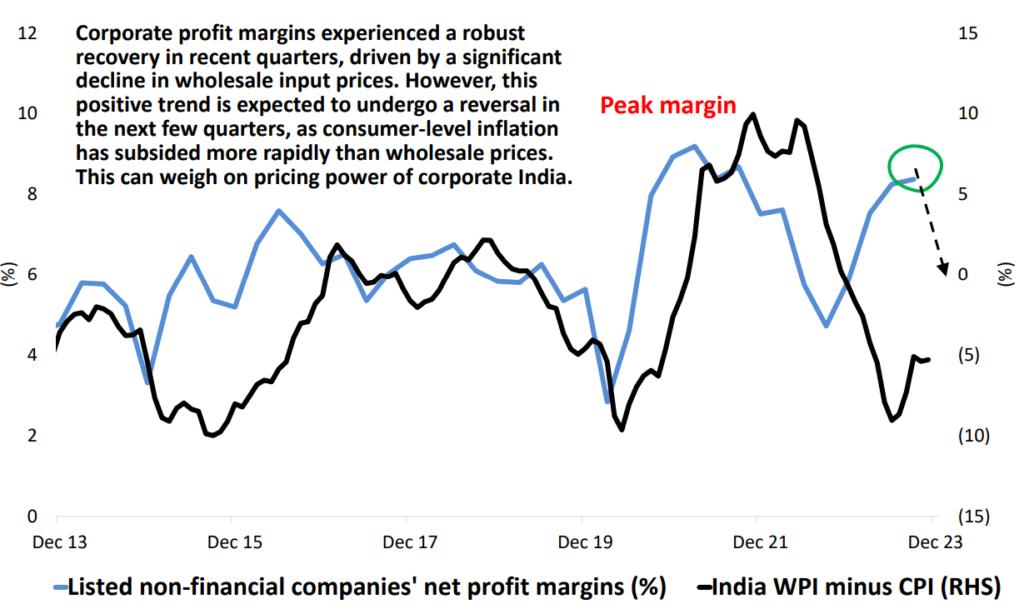

The story of Indian corporate margins also suggests tumultuous waters ahead

Recently, corporate margins in India have witnessed a sharp rebound, largely due to a significant drop in input and wholesale prices. This decline has been a key driver in expanding profit margins over the last few quarters. However, this trend may not be sustainable. Looking ahead to the next two quarters, we’re likely to see a shift. Consumer-level inflation has been easing at a quicker pace compared to wholesale prices, suggesting a potential reversal in the margin expansion trend.

This gradual benefit that corporations have reaped from the declining input costs is set to impact corporate earnings in FY24. As this advantage begins to diminish, we can expect a slowdown in earnings growth. This could, in turn, make Indian equities less appealing to investors. The immediate past has shown an upswing in margins, but the near future hints at a more challenging scenario where declining input costs might no longer bolster corporate profits to the same extent. This change is not just a financial pivot but also signals a crucial phase in the market, potentially reshaping investor sentiment toward Indian equities.

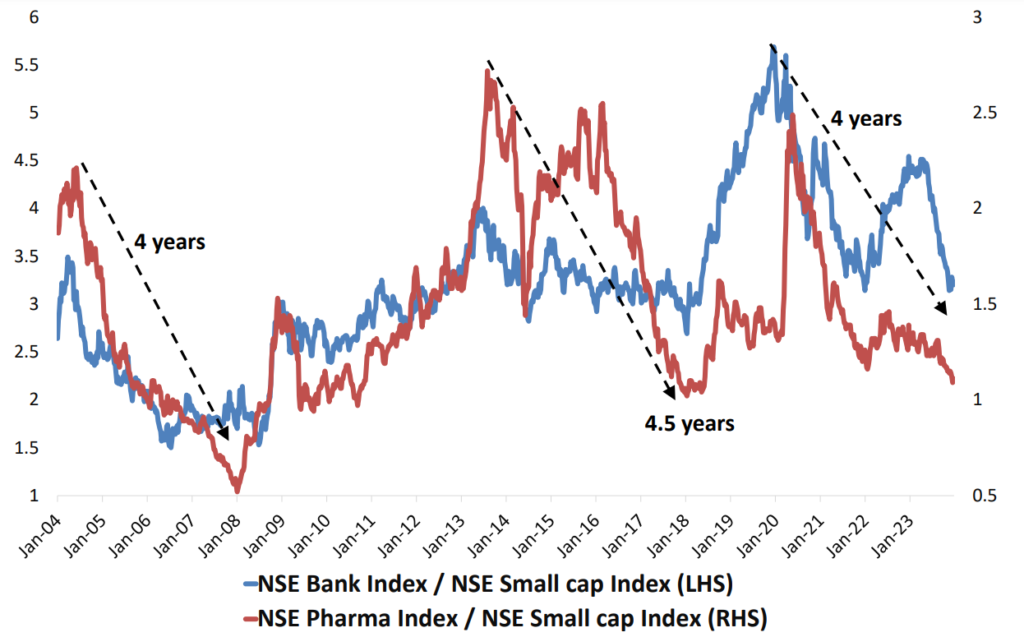

But, the investment appeal of banks and pharma in India could be the silver lining

In the Indian market, two sectors currently stand out for their investment potential. These include Banking, Financial Services and Insurance (BFSI), and Healthcare. These sectors are trading at average valuations and are experiencing a continued improvement in their financials. What’s noteworthy is their performance in relation to the performance of the ‘tail’ of the market. Here, the ‘tail’ refers to the broader small-cap universe, known for its impressive performance during times of upward valuation adjustments and strong investor sentiment.

Historically, there have been three distinct cycles, each lasting about 4 to 4.5 years, where stocks in these sectors have underperformed compared to the broader small-cap universe. Currently, we are witnessing the third such cycle. That said, one cannot deny that the superior earnings trend and attractive valuations of lender and pharma firms make them compelling investment options. It’s suggested that increasing investment weights in these areas while limiting exposure to the small-cap ‘tail’ – unless valuations are particularly appealing – could be a prudent strategy.

This insight reflects a strategic shift in investment preferences, highlighting the potential of the BFSI and Healthcare sectors in the Indian market, especially considering their historical performance trends and current financial health.

The bottom line

The beginning of 2024 has brought with it a unique set of challenges and opportunities in the investment realm. As the landscape continues to evolve, the insights provided in this edition of Netra underscore the necessity of staying informed and adaptable in our investment strategies. We aim not just to offer analysis but to deliver actionable intelligence that empowers you to make well-informed decisions in a world of constantly shifting economic narratives.

For a deeper understanding and more comprehensive insights into these topics, we invite you to access the full report. Let Netra be your guide in deciphering the complexities of the global economy and uncovering the opportunities that lie within.

Disclaimer

This document is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as on December 31, 2023 (unless otherwise specified and are subject to change without notice). Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee to the investors in above mentioned scheme. The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The sector(s)/stock(s)/issuer(s) mentioned herein do not constitute any research report/recommendation of the same and the scheme/ Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). The strategy / investment approach / framework mentioned herein is currently followed by the scheme and the same may change in future depending on market conditions and other factors.

For complete details on investment objective, investment strategy, asset allocation, scheme specific risk factors and more details, please read the Scheme Information Document, and Key Information Memorandum of the scheme available on ISC of AMC and also available on www.dspim.com. For Index disclaimer click here. Large-caps are defined as top 100 stocks on market capitalization, mid-caps as 101-250 , small-caps as 251 and above. The strategy mentioned has been currently followed by the Scheme and the same may change in future depending on market conditions and other factors.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.