Last Updated on Aug 2, 2023 by Anjali Chourasiya

A leading name in the private equity investment sector, Ashish Dhawan has emerged as one of India’s richest investors and philanthropists. His private equity firm, Chrysalis Capital, is one of the biggest funds in India. Ashish Dhawan’s portfolio is also rich with quality stocks that have catapulted his net worth to more than Rs. 3,187.3 cr.

While you may know him as the co-founder of the Young India Fellowship program at Ashoka University and co-founder and owner of private equity firm Chrysalis Capital, Dhawan rose to riches from humble beginnings. Let us delve into the journey of Ashish Dhawan and see the financial lessons that he can teach potential investors.

Table of Contents

Key details

| Name | Ashish Dhawan |

| Age | 54 |

| Spouse Name | Manisha Dhawan |

| Children | 2 Daughters (Ayla & Anya) |

| Total Net worth (Rs. in cr.) | 3,187.30 |

| No. of portfolio companies | 12 |

| Major shareholding (%) | Palred Technologies Ltd (5.50%) |

Early life

Born in 1969 in New Delhi, Dhawan graduated from Yale University and later pursued an MBA from Harvard University. His career started in 1992 when he joined the Wasserstein Perella and Company, a Wall Street boutique bank. He took a break to study MBA, after which he joined Goldman Sachs in New York in the proprietary capital department.

Laying the foundations of his business

In the year 1999, Ashish Dhawan returned home to India. Here, he co-founded Chrysalis Capital along with his batchmate from Harvard, Raj Kondur. Chrys Capital was a private equity firm which was still a new concept in those times. However, the company managed to establish itself well, and Dhawan himself became a brand personality.

Within 5-6 yrs of commencement, Chrys Capital was already managing $1 bn. This made the company one of the largest funds in India.

Venturing into education and philanthropy

Ashish Dhawan’s journey into the education sector began in 2010 when he co-founded the Young India Fellowship program. The Fellowship is a one-year residential program in multiple disciplines that focuses on experience-based learning to create the next generation of Indian leaders.

In 2012, Dhawan established the Central Square Foundation, a grant-making organisation. The foundation is engaged in providing grants and acts as a policy think-tank aimed at improving the country’s education quality. Moreover, the foundation focuses on children’s education from the lower sections of the population.

Furthermore, in 2014, Dhawan also co-founded Ashoka University with 40 other philanthropists. The university is the first-of-its-kind liberal arts university in India.

Ashish Dhawan’s portfolio

With 20+ yrs of experience in investment management, Dhawan has constructed a solid portfolio reflective of his net worth. At the end of the June 2023 quarter, he held 12 primary stocks, which stood as:

| Stock name | Holding value (Rs. in cr.) | Quantity held | June 2023 holdings in % | March 2023 holdings in % | December 2022 holdings in % |

| Religare Enterprises Ltd | 90.90 | 5,386,564 | 1.70% | – | – |

| Dish TV India Ltd | 53.70 | 28,957,491 | 1.60% | 1.60% | 1.60% |

| Glenmark Pharmaceuticals Ltd | 568.50 | 7,200,000 | 2.60% | 2.60% | 2.50% |

| AGI Greenpac Ltd | 208.50 | 3,100,000 | 4.80% | 4.80% | 4.80% |

| IDFC Ltd | 639.50 | 56,000,000 | 3.50% | 3.50% | 3.50% |

| Mahindra and Mahindra Financial Services Ltd | 472.20 | 14,600,000 | 1.20% | 1.20% | 1.20% |

| Greenlam Industries Ltd | 230.70 | 4,814,210 | 3.80% | 3.80% | 3.80% |

| Palred Technologies Ltd | 10.10 | 678,189 | 5.50% | 5.50% | 5.50% |

| Quess Corp Ltd | 251.70 | 5,861,223 | 4.00% | 4.00% | 4.00% |

| RPSG Ventures Ltd | 57.50 | 1,234,286 | 4.20% | 4.20% | 4.20% |

| Arvind Fashions Ltd | 215 | 6,564,065 | 4.90% | 4.90% | 4.90% |

| Equitas Small Finance Bank Ltd | 389 | 40,370,000 | 3.60% | 3.60% | – |

Ashish Dhawan’s portfolio analysis

One significant development in Ashish Dhawan’s portfolio in the March-June 2022 quarter was Dhawan bought 1.70% stakes in Religare Enterprises Ltd, valued at Rs. 90.90 cr. In the January-March 2023 quarter, the investor bought Equitas Small Finance Bank Ltd, valued at Rs. 389 cr. Further, in the same quarter, he increased his stake in Glenmark Pharmaceuticals Ltd by 0.10%.

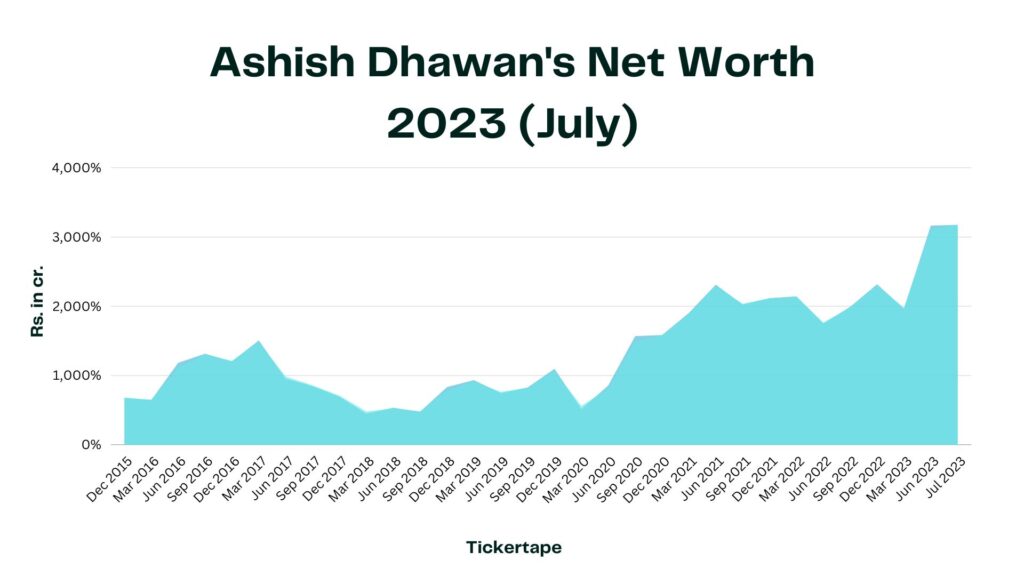

Ashish Dhawan’s net worth trend

Forbes India recognised Ashish Dhawan as the NextGen Leader in Philanthropy. For the last five years, the net worth trend of Ashish Dhawan has looked like this:

The net worth of Dhawan in July 2023 is Rs. 3,187.3 cr., the highest in the last five years. There was an evident drop in his net worth after touching the previous high of Rs. 2,544.76 cr. in September 2021. But, it recovered quickly.

Bulk and block deals in Ashish Dhawan’s portfolio

For the quarter March-June 2023, Ashish Dhawan has carried out no Bulk and Block Deals. You can use Tickertape’s Stock Deals tool to analyse Dhawan’s bulk and block deals for different periods. You can also use the tool to analyse the insider trades of big investors. This helps you gauge their outlook on the company and analyse their portfolio.

Investment lessons from Ashish Dhawan

Dhawan has managed his portfolio effectively and increased it exponentially within a span of a few years. Here are some important lessons that you can learn from Ashish Dhawan’s portfolio:

Diversification always pays

Dhawan held six telecom companies in his portfolio and also invested in companies of other sectors. When the Dot Com crash happened, Dhawan’s portfolio suffered from acute exposure to telecom stocks. However, his investment in SpectraMind gave him attractive returns. These returns helped him set off the losses. Even the current portfolio of this investment guru is diversified across sectors. Hence, diversification is essential so that gains from others can offset losses from one investment.

Long-term investment is profitable

Dhawan invested in Mphasis when the market price was Rs.350. After that, the stock prices plummed sharply to Rs. 50. Rather than panicking, Dhawan held onto his stock with rock-solid belief in the company. The same Mphasis stock later earned him 5x returns.

So, even when the markets turn volatile, they largely dilute in the long term. If you have invested in sound companies, do not fear fluctuations.

Understand the company that you invest in

Dhawan has incurred his fair share of losses by investing in sub-par stocks. However, these failures taught him the lesson to study the company judiciously before investing and also the importance of monitoring. When Max Healthcare stock started falling in the markets, Dhawan was able to make an informed choice to exit the company and cut down his losses without remorse.

So, before investing your hard-earned money, understand the basics of the company that you are investing in. Moreover, realise that all trades will not result in great returns. It is better to cut your losses early on than wait for corrections to happen.

The bottom line

Ashish Dhawan is one of the biggest stars in the investment world. Through hard work and failures, he has carved a name for himself in the market. Besides being a smart investor, he is also a wise entrepreneur and a big-hearted philanthropist. With his endeavours in social welfare causes, Dhawan has constantly been giving back to society. You can take valuable lessons from his life and investment journey and create a profitable portfolio for yourself too.

- Long Term Mutual Funds in India (2025) - Oct 29, 2025

- Muhurat Trading in 2025 – Meaning, Benefits, Latest Date and Timings - Oct 8, 2025

- How To Withdraw Mutual Funds? - Jun 6, 2025