Last Updated on Oct 14, 2022 by

While many investors know what equity mutual funds are, very few know about the nuances of debt mutual funds. Due to a limited understanding of these funds, investors are usually a little apprehensive about investing in them. They get intimidated by the jargon, which makes decision-making difficult for investors.

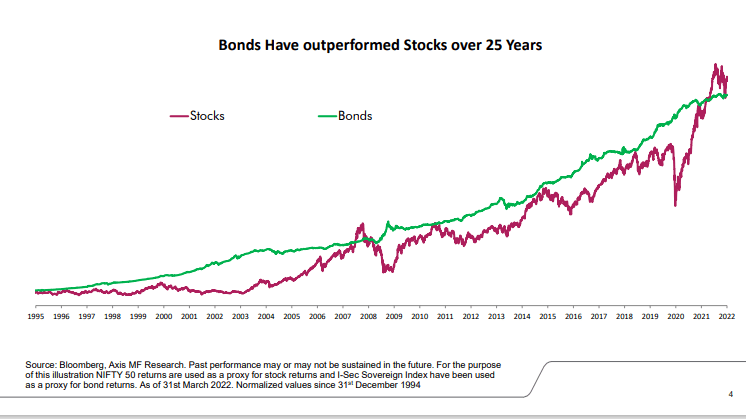

However, investors may miss out on opportunities to diversify their portfolios by not considering investing in these funds. The chart given below shows the performance of bonds since 1995. Bonds have most of the time outperformed stocks over the last 25 yrs. It might clearly indicate the opportunity that investors are yet to leverage. This article will explain the basic jargon and parameters we should check when selecting a debt mutual fund.

Depending on the fund’s investment objective, debt mutual funds invest the corpus in bonds/ money market instruments issued by private companies, public companies or the government. Debt mutual funds can be directly affected by interest rate movements as the price of bonds have an inverse relationship with interest rates. When interest rates fall, debt funds typically invest in long-term duration bonds, as with rate cuts, prices of bonds increase. Also, short-term papers face relatively high reinvestment risk. Whereas when interest rates rise, debt funds invest in short-term duration bonds as they would want to safeguard returns on account of higher MTM (mark-to-market) losses on long-duration bonds.

Investing in debt funds allows investors to choose a minimally correlated strategy in addition to other assets that can help investors mitigate risk and counterbalance the portfolio.

With expectations of the rates further tightening in the upcoming monetary policy, investors could potentially consider fixed-income funds with short to medium-term duration to protect the absolute value of their investments. Before investing in such products, investors should also ensure that their investment horizon should be more than 12 months.

Some of the important aspects to consider while investing in debt funds are:

- Investment Horizon: The period investors stay invested in a fund is referred to as the investment horizon. This gives an idea about the investor’s risk appetite and income needs, through which an investment can be selected.

Determining an investment horizon is one of the crucial steps an investor must take when creating a portfolio. Investors must match their investment horizon with the average duration of the debt fund. The shorter the investment horizon, the lower the risk profile of an investor. Hence, investors with a low-risk profile can select money market or short-term funds with a relatively low duration and less volatility in their returns.

On the other hand, if the investment horizon is long, investors invest in medium to long-term funds like target maturity funds which can help them to take benefits of the interest rate cycle over a medium term. - Duration profile: Duration is a measure of bond risk. Normally, funds with higher duration tend to have a higher sensitivity to changes in the rate of interest. That is why investors should buy funds with longer duration when interest rates are expected to go down, and when interest rates are likely to stabilize or go up, they should buy funds with lower duration. Based on an investor’s risk appetite, they can choose a debt fund with lower or higher interest rate sensitivity.

- Credit rating profile: Credit ratings of debt funds is an important indicator to show the credit risk and quality of the fund. The holdings of a debt fund are categorised based on credit ratings given by rating agencies ex. AAA, AA+, A1+ – etc. AAA signifies high quality with lower credit risk and is well-suited for investors who want minimal risk. On the other hand, lower-rated debt papers are high on risk and are likely to give higher yields. Depending on the risk appetite, an investor may decide on the fund basis the ratings of the fund’s holdings.

What can investors do?

Given the current macro environment, fixed income strategies have the potential to be a good entry point for several investors. The peak of inflation for the near term is broadly behind us, and due to front-loading of rate hikes, the curve has massively flattened across duration (1-yr X 10 yrs is ~ 75 bps spread v/s ~200 bps 6 months back); hence investors can look for strategies that invest in the belly of the curve (1-4-yr duration strategies). Absolute levels of 2/4-yr AAA corporate bonds/SDLs (State Development Loans) are very attractive from a medium-term investment horizon.

In such a situation, investors with a flat yield curve may look for fixed Income strategies like short-duration or medium-term. Investors also have the option to choose between actively or passively managed debt portfolios. In fact, risk-averse investors are encouraged to consider passive debt funds in their portfolios with pre-determined maturities.

Sources: Axis AMC Research, AMFI

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Sectors mentioned above are for illustration purpose and should not be construed as recommendation.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

- How To Select Debt Mutual Funds? - Oct 11, 2022