Last Updated on Apr 6, 2021 by Manonmayi

Insider trading is a term subject to many definitions and connotations and it encompasses both legal and prohibited activities.

Insider trading is the buying, selling, or dealing in securities of a listed company by a director, member of management, employee of the company, or by any other person such as internal auditor, advisor, consultant, analyst, etc, who has knowledge of material inside information which is not available to the general public.

Insider trading takes place legally every day, when corporate insiders – officers, directors, or employees – buy or sell stock in their own companies within the confines of company policy and the regulations governing this trading. Hence, Insider trading can be legal as long as it conforms to the rules set forth by SEBI.

Table of Contents

Bulk Deal

A bulk deal is a trade, where the total quantity bought or sold is more than 0.5% of the number of equity shares of a listed company.

Bulk deal can be transacted during the normal trading window provided by brokers throughout the trading hours in a day. Bulk deals are market-driven and take place throughout the trading day.

Insider trading laws have a significant impact on the stock market and the conduct of investors.

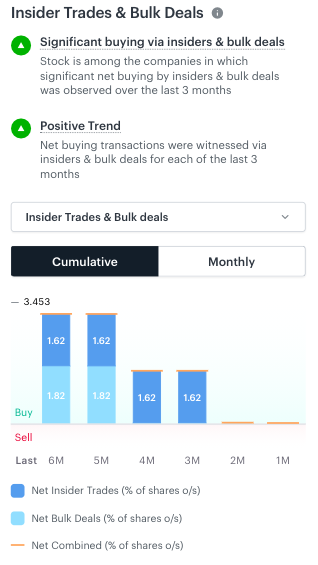

You can find this information now on Tickertape. All you have to do is search for your favourite stock and go to the holdings tab.

This feature is available only for pro users. Upgrade your account now.

How does it affect the market?

Illegal trading weakens the faith of investors and the entire market so much so that it can harm the economy as a whole.

All market participants are primary stakeholders. They are directly affected by insider trading because of a lack of information on their side required to make informed decisions. Market participants involve anyone who owns traded stock through financial instruments, including individuals stocks, portfolios, mutual funds, retirement plans, educational savings plans, etc., and all beneficiaries of such instruments. Primary stakeholders also include the individuals, small groups, or companies who benefit from inside information, such as those who execute trades with non-public information and those who could possibly benefit from knowing about more efficient market prices.

Secondary stakeholders might not own the traded stock but they may lose confidence in the market and other members who suffer losses may withdraw from the market causing the market to become illiquid and more competitive.

How to protect yourself

As an investor, you should be cautious to avoid getting into the quagmire of insider trading scams. Never invest in a company or an industry that you have never heard of even if you get an insider infomation.

For detailed information on insider trading and bulk deals visit, our Learn section.

- Top 10 Most Popular Stocks on Tickertape - May 19, 2023

- Redflags 101: Protect Your Portfolio From Harmful Indicators On Tickertape - May 5, 2023

- Launching insider trades and bulk deals - Oct 9, 2020