Last Updated on Apr 15, 2025 by vanessa sequeira

The semiconductor industry has come into the limelight in recent years. This is especially true since the semiconductor industry has come into the spotlight recently. This spike in interest was owed to the advent of the pandemic – when the demand for semiconductors increased immensely, but supply constraints resulted in a global shortage. However, because of their crucial application in electronic devices, listed semiconductor manufacturing companies in India continue to enjoy popularity. In this article, let’s take a look at the industry overview, semiconductor stocks in India, and why the sector is likely to be a lucrative investment option.

Table of Contents

Best Semiconductor Stocks in India

Here is a list of the best semiconductor stocks in India sorted according to market cap:

| Name | Sub-Sector | Market Cap | Close Price (Rs.) | PE Ratio |

| HCL Technologies Ltd | IT Services & Consulting | 4,67,656.97 | 1,712.30 | 29.78 |

| Vedanta Ltd | Metals – Diversified | 1,63,349.57 | 423.50 | 38.53 |

| Dixon Technologies (India) Ltd | Home Electronics & Appliances | 84,139.96 | 14,088.30 | 228.80 |

| Tata Elxsi Ltd | Software Services | 37,977.11 | 6,017.60 | 47.94 |

| Moschip Technologies Ltd | Plastic Products | 3,690.68 | 169.82 | 373.93 |

| RIR Power Electronics Ltd | Electronic Equipments | 1,383.19 | 1,712.40 | 197.04 |

| MIC Electronics Ltd | Electrical Components & Equipments | 1,369.43 | 59.66 | 22.15 |

| ASM Technologies Ltd | IT Services & Consulting | 1,265.26 | 1,145.00 | -295.62 |

| Solex Energy Ltd | Industrial Machinery | 897.52 | 840.60 | 102.81 |

| SPEL Semiconductor Ltd | Electronic Equipments | 524.59 | 123.00 | -31.26 |

| Surana Telecom and Power Ltd | Cables | 258.08 | 19.43 | 32.02 |

Note: The list of Indian semiconductor companies is derived from Tickertape Stock Screener. The information provided here is as of 19th February, 2025 and is based on market capitalisation.

Overview of the Top 10 Semiconductor Stocks in India

Here are brief overviews of the top 10 semiconductor companies in India, including the top 5 semiconductor stocks in India:

HCL Technologies Ltd

Founded in 1976 and one of the NSE-listed semiconductor companies in India, HCL Technologies is a multinational IT and consulting company. It provides various software development services, business process outsourcing services, and information technology infrastructure services.

Vedanta Ltd

Founded in 1965, Vedanta is a global diversified natural resource company operating across segments: aluminium, copper, power, iron ore, lead, silver, zinc, oil, gas, etc. The company has finalised a technology partnership with Taiwanese firm Innolux and is also close to finalising a partnership for semiconductor manufacturing. This makes it one of the best semiconductor stocks for investors looking at the semiconductor share list in India.

Dixon Technologies (India) Ltd

Dixon Technologies is a multinational contract manufacturer of electronics like washing machines, televisions, smartphones, LED bulbs, etc. The company was founded in 1993 as Weston Utilities Ltd. It is also a key player in the semiconductor share list of India.

Tata Elxsi Ltd

Founded in 1989, Tata Elxsi is involved in the design and development of computer software and hardware. The company operates in two segments: system integration and support and software development and services.

Moschip Technologies Ltd

Founded in 1999, Moschip Technologies is a semiconductor and system design services company which focuses on mixed-signal IP, Turnkey ASICs, IoT solutions, semiconductor and product engineering catering to several sectors like automotive, medical, networking and telecommunications, consumer electronics, aerospace and defence.

ASM Technologies Ltd

Founded in 1992, ASM Technologies offers business and technology consulting, application maintenance, enterprise solutions, product support, etc.

MIC Electronics Ltd

Founded in 1988, MIC Electronics is a manufacturer of electric lighting equipment. The market capitalisation of the company is Rs. 2,244.69 cr.

Ruttonsha International Rectifier Ltd

Founded in 1969, Ruttonsha International Rectifier is a manufacturer of power semiconductors and has over five decades of association with International Rectifier, USA.

Solex Energy Ltd

Founded in 1998, Solex Energy manufactures solar panels, solar lighting systems, solar water pumping products and water heater products.

SPEL Semiconductor Ltd

Founded in 1984, SPEL Semiconductors is India’s first Semiconductor IC assembly and test facility provider.

How to Invest in the Best Semiconductor Stocks with smallcase?

smallcases are portfolios of thematic stocks created and managed by SEBI-registered analysts. A smallcase allows an investor to diversify their portfolio in the sector. Among numerous smallcases, the semiconductor smallcases are as follows –

- Disclosure for Ancillary smallcase

- Disclosure for Electric Mobility smallcase

Note: The smallcases are mentioned only for educational purposes and are not meant to be recommendatory. Investors must conduct their own research and consult a financial expert before making any investment decisions.

Relevant Union Budget 2025-26 Implications on the Semiconductor Industry in India

The Union Budget 2025–26 underscores the Government of India’s continued commitment to bolstering domestic semiconductor capabilities through enhanced funding and supportive policies. Below are the key takeaways and implications of the Union Budget 2025-26 for the semiconductor sector in India:

- The government has earmarked Rs. 7,000 cr. for the semiconductor sector. This earmarked corpus aims to cover various segments of semiconductor manufacturing—ranging from fabrication and packaging units to research, development, and design initiatives. The outlay, as part of the broader Production Linked Incentive (PLI) and allied incentive schemes, marks a notable expansion in the government’s commitment to high-tech electronics manufacturing.

- Beyond pure manufacturing incentives, the Budget prioritises capacity building, encouraging the establishment of local fabless design startups and the development of advanced testing and packaging infrastructure.This integrated approach is intended to attract global semiconductor firms while simultaneously fostering an indigenous ecosystem—covering the entire value chain from chip design to fabrication.

- Reflecting India’s aspiration to become a hub for semiconductor innovation, the government has introduced targeted programs for research and development in chip design. Collaborations with academia and global technology leaders are envisaged to expedite the training of specialised talent, underscoring the Budget’s emphasis on skilling and upskilling in advanced electronics.

What is a Semiconductor?

A semiconductor is a tiny chip that gives life to electronic devices. It manages the flow of electricity in electronic products like smartphones, computers, electric vehicles, medical equipment and gaming hardware. Semiconductors are used in consumer electronics like ACs, rice cookers, CPUs, and commercial devices such as ATMs, trains, and other infrastructures.

These are also used in Electric Vehicles (EVs). And you need not one, but hundreds of chips to make a standard EV. The advancements in artificial intelligence (AI), the Internet of Things (IoT), and other forms of technology have shot semiconductor demand worldwide. However, the supply chain constraints and global shortage have put the semiconductor industry under immense stress lately.

What are Semiconductor Stocks?

Semiconductor-related stocks in India represent shares in companies that design, manufacture, and distribute semiconductors or chips. Stocks of chip manufacturing companies in India are integral to the electronics industry, producing tiny chips that power a wide range of devices, from smartphones and computers to electric vehicles and medical equipment.

Investing in semiconductor stocks allows individuals to participate in the growth and advancements of the technology sector. Notable semiconductor companies listed in India include Intel, AMD, NVIDIA, and Qualcomm. Investors often track semiconductor stocks listed in India to gauge trends in technology and the overall health of the electronics market.

Impact of Semiconductor Shortage

Supply chain constraints and a global shortage have made the semiconductor market quite volatile for two years now. The supply chain disruptions in the semiconductor space have impacted over 169 industries across countries, including India. As per Deloitte, the chip shortage over the last two years has resulted in a revenue loss of over $500 bn.

What explains the global semiconductor shortage?

As per S&P Global Engineering Solutions, semiconductor shortage is not new. It is cyclical. Historically, the periods of shortages have lasted six months to a year, but the current one has deviated from that trend. A few reasons for this are:

Unforeseen events before and during the pandemic

In early 2019, a fire in Ukraine impacted the production of semiconductor packaging material. In March 2021, a fire in Japan’s Renesas fabrication (fabs) facility forced the microcontroller production to go offline for 3 months. Most of its chips supported the automotive industry. At the same time, a cargo ship stuck in the Suez Canal blocked the passage for over a week, impacting the chip delivery in transit.

In October 2021, staffing shortages resulted in 77 ships getting bottlenecked outside the Los Angeles and Long Beach docks. In February of the following year, an ice storm in Texas resulted in a power outage and forced Samsung, NXP, and Infineon fabs to halt production.

These events cumulatively disrupted semiconductor companies in India share prices and the global supply chain.

The COVID pandemic

Challenges escalated in 2020 when pandemic-triggered lockdowns forced semiconductor manufacturing companies in India on the stock market to stop production. The auto sector, which accounted for most of the demand, cut down its orders, anticipating a drastic fall in car sales.

However, with businesses undergoing digital transformation, the demand for chips has shot from newer products like home IT equipment, smartphones, and recreational products like PlayStations and VR headsets. This meant that the semiconductor market had to transition from producing lower-cost car chips to expensive processors for consumer goods.

With a huge gap in demand and supply, things got messy. By the time economies started opening up, demand from the auto industry had added to the existing consumer goods orders. Thus began the automotive chip shortage.

Geopolitical issues between the US and China

Southeast Asia, China, and Taiwan have been the hub for chip factories. However, the geopolitics issues and trade war between China and the US made things hard. China’s tech crackdown and its challenge with Taiwan worsened things.

New semiconductor factory construction

To bridge the immense gap in demand and supply of semiconductor chips, countries across the globe commissioned new fab units. Upcoming semiconductor companies in India and foundries have started planning for 29 new semiconductor factories across China, Taiwan, the US, Japan, and Korea. It takes ~3 years for fabs to become operational. While the industry expects 200 fabs to become operational by 2026, the construction of fabs has its own challenges due to a shortage of materials and labour.

Overview of the Semiconductor Industry in India

Currently, India imports 100% of its semiconductors, majorly from Taiwan, China, Korea, and Vietnam. This results in a huge import value of ~$24 bn. The Ministry of Electronics and Information Technology estimates that India’s semiconductor market will grow to $63 bn, four times the current market, by 2026. And with the 5G rollout around the corner, the semiconductor demand may break the ceiling.

On January 18, 2024, the government approved a deal between India and the European Union. The goal is to collaborate on semiconductor research, innovation, and technology development. This partnership aims to make the semiconductor supply chain stronger in both India and the EU. It covers cooperation in wide areas, including research and innovation, talent development, partnerships, and the exchange of market information.

How is India Planning to Address the Global Semiconductor Shortage?

The global semiconductor shortage and supply constraints have impacted various sectors of the Indian economy. The government has taken several measures, as discussed below, to be better prepared to meet the demand for chips.

Funds sanctioned under the PLI scheme

The government has earmarked Rs. 76,000 cr. in the Production-linked Incentive (PLI) scheme for semiconductor and display manufacturing. Of the sanction amount, Rs. 2.3 lakh cr. is reserved to encourage the domestic manufacturing of semiconductors. This will significantly benefit Indian chip manufacturers and bolster the semiconductor business in India.

The objective is to help create a semiconductor ecosystem in India. The scheme will likely support the opening of ~20 semiconductor manufacturing stocks in India in the coming six years. Additionally, design, components, and display fabs are expected to be started. The scheme will also offer much-needed financial assistance to the best semiconductor companies in India. The subsidies will reduce microchip manufacturing companies in India’s production costs, encouraging them to increase production and maximise profits.

Apart from helping the top semiconductor companies in India listed in NSE, the PLI scheme is also expected to create employment opportunities there. As per the government, ~35,000 specialised and 1 lakh indirect job opportunities will be created. Not only this, but the scheme could also generate investments of ~Rs 1.7 lakh cr.

Semicon India Program

To reduce its import dependency and help solve the global chip crisis, the Indian government also announced a ‘Semicon India Program’ in December last year. The program welcomes semiconductor companies to build and operate their plants. The government has offered financial support of up to 50% of a project’s cost to eligible manufacturers, promoting the growth of semiconductor companies’ stocks in India.

The government accepted proposals from international chip manufacturers, and chip manufacturing companies in India like TSMC, Foxconn, Fujitsu, Intel, and AMD had shown interest. Tata Group, one of the key players in AI chip manufacturers in India, had also announced plans to invest up to US $300 mn in a semiconductor assembly and test unit in South India. In December last year, Vedanta announced to invest ~US $15 bn on a semiconductor plant. And recently, it cheered the market by announcing progress on the front.

Why Invest in Top Semiconductor Stocks in India?

The government has taken several measures, such as sanctioning funds under the PLI scheme and announcing the Semicon India Program. This aims to make India a prominent hub for the manufacturing of semiconductors, thereby boosting the top semiconductor stocks in India. Private companies, both domestic and international, have responded positively to this. Some of the examples are:

- Multinational mining company Vedanta announced a joint venture with Taiwanese-based Foxconn. It has also signed two Memorandum of Understanding (MoUs) with the Government of Gujarat to set up semiconductor and related facilities in Ahmedabad.

- Tata Motors and Tejas Networks Ltd joined hands with Japan-based chipmaker Renesas Electronics Corp to design, develop, and manufacture Renesas’ semiconductor solutions for emerging markets, including India.

- Rajesh Exports is planning an investment of $3 bn to set up India’s first electronic display plant in Telangana. The company has also applied for the PLI scheme.

- When the government invited bids for semiconductor fab units, Ruttonsha was the only entity registered to make compound semiconductors. The company was taken over by US-based Silicon Power Corporation in 2005, opening up doors to developmental and technological expertise.

- SPEL Semiconductor was the only one registered for semiconductor packaging under the PLI scheme.

These initiatives and partnerships demonstrate that investing in semiconductor company shares is a lucrative option, provided that plans and partnerships are executed well.

Things to Consider Before Investing in the Best Semiconductor Stocks in India

- You can ensure that the company has displayed a consistent increase in its revenue growth. Moreover, it should also be able to translate sales into profits. Only then can it reinvest profits into research and operations to grow the business further.

- Companies among the chip stocks in India must have strong financials. Scan its income statement, balance sheet, cash flow statement, annual report, and other important documents to analyse the company’s past and current performance. This would indicate its prospects and guide you in making the right investment decision.

- Beware of the risks and developments in the semiconductor industry and within the company.

- Although the government is putting much effort into making India a global semiconductor hub, the ecosystem would need time to form, maintain, and grow. Initially, the best semiconductor companies in India would spend immense resources on research and operations, which would increase their costs and limit their profits. So, it would be best if you have a long-term horizon in mind.

- Do not follow recommendations, tips, and unsolicited advice blindly. Consult a financial advisor if need be, but ensure that you invest only after thoroughly analysing the semiconductor stocks in India.

How to Analyse a Semiconductor Stock in India?

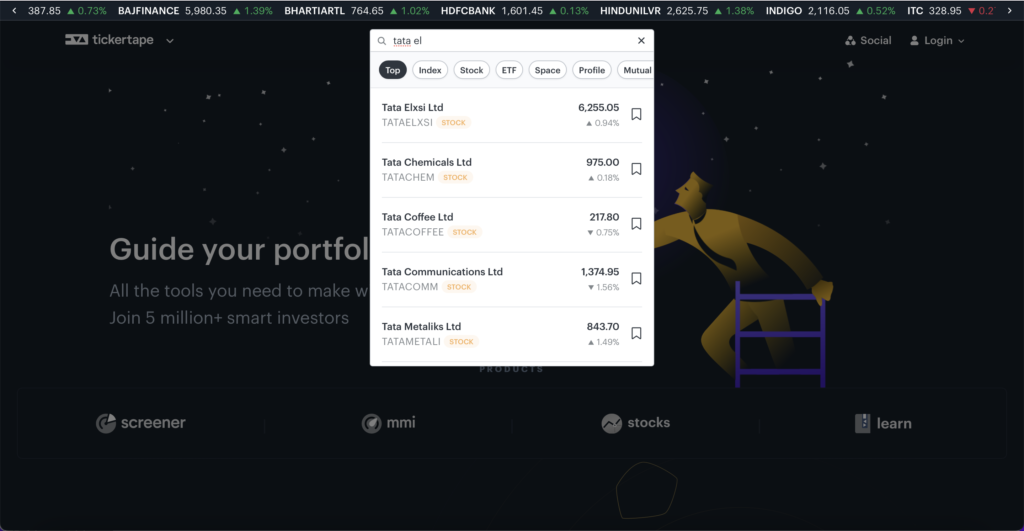

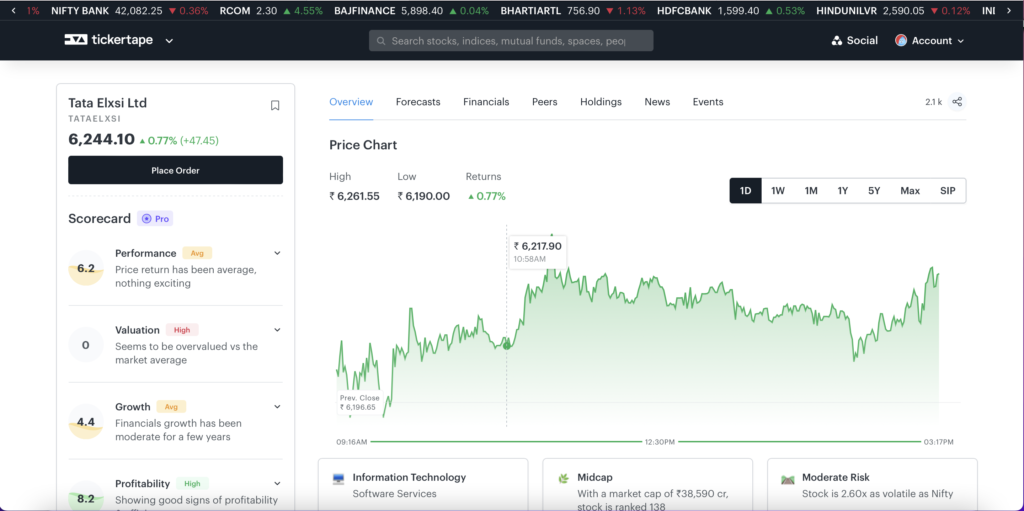

You can use Tickertape to analyse any stock in the NSE. Follow the steps below to analyse a stock on Tickertape.

- Log in Tickertape

- Enter the names of the semiconductor stocks in the search bar

- You’ll get all the information regarding a stock – its current price, 1W returns, 3M returns, 1Y returns, and 5Y returns along with the key metrics of the stock. Not just that, you can go through the financials of the company in the ‘financials’ tab.

- You can also check the Scorecard, which provides scores for performance, valuation, growth and profitability of a stock.

Frequently Asked Questions (FAQs) About Semiconductor Stocks

1. What can replace semiconductors?

Businesses are constantly innovating to offer better products and increase their profitability. Therefore, it is no surprise that semiconductor chips have an alternative. As of now, silicon carbide is said to be a key contender to chips. However, such alternatives would require years to replace semiconductors as they would require ample research before production.

2. What is the semiconductor stocks list?

Tata Elxsi Ltd, ASM Technologies Ltd, Dixon Technologies (India) Ltd, SPEL Semiconductor, and others are a few semiconductor stocks in India. Scroll to the top to find a longer semiconductor share list in India.

3. What are the semiconductor stocks in NSE?

Currently, there are 11 semiconductor stocks in NSE. They are,

– Tata Elxsi Ltd

– ASM Technologies Ltd

– Dixon Technologies (India) Ltd

– SPEL Semiconductor Ltd

– Moschip Technologies Ltd

– Ruttonsha International Rectifier Ltd

– HCL Technologies Ltd

– MIC Electronics Ltd

– Surana Telecom and Power Ltd

– Vedanta Ltd

– Solex Energy Ltd

4. Who should invest in semiconductor stocks in India?

Semiconductor stocks in India suit tech enthusiasts, long-term investors, and those interested in the technology sector. Investors with industry knowledge and risk tolerance, monitoring global trends, can find opportunities and consider semiconductor shares in India. Thorough research and consultation with a financial advisor are essential before considering semiconductor stocks in India.

5. What are the semiconductor penny stocks in India?

With a close price of Rs. 23.09, Surana Telecom and Power Ltd is the only semiconductor penny stock in India under Rs. 50.

6. How many semiconductor companies are there in India?

India has a growing semiconductor industry, primarily focusing on design, with companies like Tata Elxsi, Wipro, and MosChip Technologies playing significant roles.

- Best Performing Small-Cap Mutual Funds in India (2025) - Apr 15, 2025

- Best Equity Mutual Funds in India: Compare Top SIP Options - Apr 15, 2025

- Top SIP Mutual Funds in India (2025) - Apr 15, 2025