Businesses can use various methods to determine their capital allocation. This helps them plan and organise their resources. Capital budgeting is one of the most popular methods to do this.

But what is capital budgeting? Is it the same as asset allocation? Let’s dig deeper into this concept and understand its various features, methods, and uses.

Capital budgeting meaning

Capital budgeting, also known as investment appraisal, refers to the process used by businesses to evaluate long-term capital investments, such as machinery, plants, products, and research and development, and to determine whether or not they should be carried out.

Capital Budgeting – All You Need to Know!

- Capital budgeting is a process that enables businesses to assess investment opportunities.

- It can reveal the risks and opportunities associated with a potential investment, allowing businesses to make rational decisions.

- The three main steps in the capital budgeting process are: finding investment opportunities, assessing them, and then selecting the most profitable ones.

- Several different methods are used to assess the potential returns that an investment could generate in the future. Four important methods are the Payback Period method, the Net Present Value (NPV) method, the Internal Rate of Return (IRR) method, and the Profitability Index method.

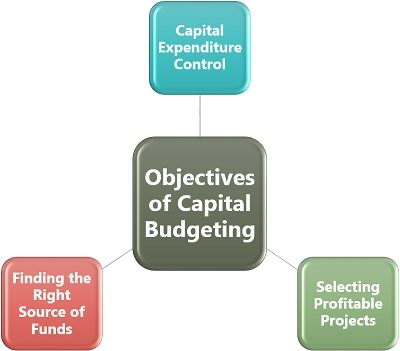

Objectives of capital budgeting

The main objectives of capital budgeting are as follows:

- Getting the best returns on investment (ROI)

Capital budgeting helps businesses select the best investments from a range of potential investments to get the best ROI.

- Controlling capital expenditure

Capital budgeting helps forecast capital expenditure requirements and prepare for them, thereby controlling the total capital expenditure.

- Determining where funds should come from

At any given time, a business can have several sources of funds for investments. In addition to determining how much capital will be needed for a certain investment, capital budgeting also helps determine the source of that capital. Moreover, if a loan has to be taken out to fund an investment, capital budgeting also helps strike a balance between the cost of borrowing and the ROI.

The capital budgeting process

Typically, the process of capital budgeting consists of the following steps:

- Finding potential investment opportunities

The kind of investments a business might consider depends on what that business does and its ambitions. For instance, a manufacturing company might consider certain new products as potential investments, while a chemical processing company might consider a new plant a potential investment.

In any event, a business must identify investment opportunities aligned with its goals.

- Assessing investment proposals

Once some viable investment opportunities have been identified, the next step is to evaluate the potential of these opportunities, along with various other details. For instance, if a company is considering adding some new products to its set of offerings, then there are several different ways it can do so: it can manufacture them on its own, outsource its manufacturing, or simply purchase them from a third party.

- Selecting the most profitable investments

Once the identified opportunities have been thoroughly assessed, the business has to examine which investments will be the most profitable, given the total capital to spend.

Capital budgeting methods

Several methods can be used to carry out capital budgeting and determine whether or not a potential investment is worthwhile. Four important such methods are:

- Payback period method

The ‘payback period’ refers to the time a potential investment will take to produce enough income to cover the initial investment amount. The potential investment with the shortest payback period will be given priority.

Payback period (in years) = Initial cash investment / Annual cash flow

- Net present value method

NPV is calculated as the sum of discounted after tax cash flows – the initial investment.

If the NPV of an investment is positive, it should be considered a good investment. If there are several potential investments with a positive NPV, those with a higher NPV should be favoured.

- Internal rate of return method

This method is also based on the NPV. The internal rate of return (IRR) refers to the discount rate that causes the NPV to be zero. In other words, it is the discount rate at which the discounted cash inflows are equal to the discounted cash outflows.

If the IRR for a given potential investment is greater than its average cost of capital, it is a good investment. Again, if there are multiple potential investments where this is the case, the investments with the highest IRR will be given priority.

- Profitability index

This method involves the use of what is known as the profitability index, which is given by the formula:

Profitability index = Present value of future cash inflows / Initial investment

If the profitability index is less than 1, then that means that the cash inflows are lower than the initial investment. Conversely, if it is greater than 1, that is a good sign, and the corresponding investment will be considered good.

Significance of capital budgeting

Some of the main advantages of the capital budgeting process are:

- It enables companies to rationally assess investment opportunities.

- It helps companies control and keep tabs on their capital expenditure.

- It clarifies the risks and opportunities available in the market and their consequences for a given company.

- If applied correctly, it can help improve a company’s profitability, thus adding more value to shareholders.

- It can help prevent companies from overspending on investment or under-utilising their capital.

Limitations of capital budgeting

- Many estimates have to be used during this process, including the initial capital that will be required or the future income that will be generated. If these estimates are incorrect, then the business’s performance might suffer at a later point in time.

- The time horizons that capital budgeting works with are typically quite long. This increases the negative impact of any incorrect estimates. Moreover, longer time horizons also mean that issues such as unexpected competition and technological or regulatory innovations can have a major impact.

- The time value of money is accounted for either by taking out a loan, paying interest, or using one’s own capital. Proper knowledge of discount rates is essential to deciding on the right course of action. Again, estimating these rates is a difficult task that can lead to unpredictable results in the future.

Conclusion

Thus, it should be clear that capital budgeting is important for modern businesses and can help companies make rational and justified decisions regarding the investment opportunities that may be available to them. Understand the process of capital budgeting in detail to make better decisions.