Preference shares are those shares of the company that have priority over common shares to receive dividends. Preference shareholders usually have a fixed rate of dividend. However, preference shareholders do not get the same rights as equity shareholders. They usually do not have the right to vote or participate in decision-making.

Let’s explore preference shares, their features and more in detail.

Preference Shares – Important Points to Note

- Preference shares are those shares that have a priority over common shares to receive dividends.

- The rights of preference shareholders differ from the rights of equity shareholders.

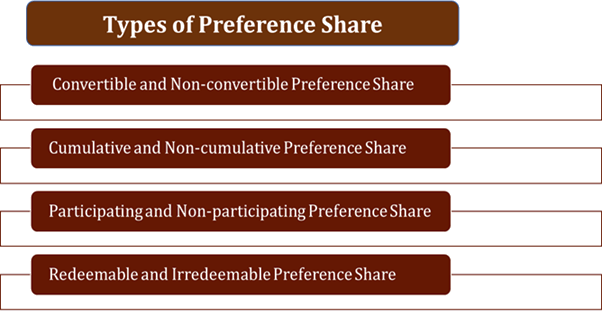

- There are different types of preference shares divided based on convertibility, redemption, dividend, and participation.

Characteristics of preference shares

Some features of preference shares are-

- Preference in dividends– Preference shareholders get priority to receive dividends over other shareholders.

- Preference in assets- In case a company liquidates or goes bankrupt, preference shareholders have the right over assets before common shareholders.

- Convertibility– Preference shares can also be converted into equity shares (based on terms and conditions and time period).

- Voting right– Preference shareholders do not participate in voting. They also have no say in decision-making.

Types of preference shares

Preference shares can be classified based on-

As per convertibility–

- Convertible preference shares

Shares that can be converted into equity shares after a fixed period are generally referred to as convertible preference shares. Ideally, these shares are regarded as advantageous for investors who plan to obtain share dividends. It also benefits people who want to profit from price changes of shares.

- Non-convertible preference shares

Non-convertible preference shares are those preference shares which cannot be converted into equity shares.

As per redemption-

- Redeemable preference shares

These shares can be bought back by the company at a predetermined rate and time based on the company’s or the shareholders’ discretion. Redeemable preference shares usually mitigate the effect of inflation and are also known as preference shares with a callable option.

- Irredeemable preference shares

Irredeemable preference shares are those shares that the company cannot redeem in the normal course of business. These shares can only be redeemed during the winding up of a company.

As per dividend-

- Cumulative preference shares

Cumulative preference shares are those preference shares that have the right to receive dividends in arrears. Even when the company has not generated profits and does not have the capacity to pay dividends, cumulative shareholders have the right to claim dividends.

Such shareholders do not lose out even when the company is not performing well.

Cumulative dividend (per share) = Quarterly dividend * Number of dividends missed

- Non-cumulative preference shares

Non-cumulative preference shares are those preference shares that are not bound to receive dividends when the company has not generated any profits.

As per participation-

- Participating preference shares

Participating preference shares are those that have the right to receive a fixed dividend rate and additional dividends based on the profit surplus of a company. These are primarily issued in cases of hostile takeovers and forced M&A deals.

- Non-participating preference shares

These shares do not have the right to receive additional dividends based on the company’s surplus earnings. These shareholders are bound to receive a predetermined dividend.

Note: There is also a type of preference share known as adjustable-rate preference shares. These shares have a dividend rate, which is fixed, based on the interest rates in the market.

Relation of interest rates with preference shares

Preference shares have similar characteristics as that of stocks and bonds. Just like bonds that provide investors with fixed returns and are sensitive to interest rates, preference shares are inversely proportional to interest rate changes.

If interest rates fall, the value of preference shares will rise. The reverse also holds true. For instance, if interest rates decline by 2%, there is a good chance that preference shares will increase by 2%.

Why should you consider investing in preference shares?

Preference shares offer various benefits.

Firstly, they act as a fixed source of passive income because the dividends are received regularly. There is also a low risk of capital loss because they have a preferential right over the company’s assets in case of liquidation.

Additionally, preference shareholders also have an edge as they are entitled to receive dividends before equity shareholders. In some cases, they can convert their preference shares to equity shares.

These shares are also generally more stable. Thus, preference shares are stable financial instruments that offer various benefits with limited risk and downfall.

Risks associated with preference shares

With all this upside, there are also certain risks attached to preference shares.

Firstly, preference shareholders do not have the right to vote and participate in decision-making. This means the decisions of the company can impact preference shareholders negatively.

Secondly, if a company is performing exceptionally well and producing high profits, the preference shareholders will lose and not benefit from this due to the fixed dividend rate. Also, when a company is not making sufficient profits, then the dividend may not be paid to preference shareholders. Therefore, the returns and risks should be carefully weighed before investing in preference shares.

Conclusion

A preference share is a unique category of financial instruments. They share properties of debt as well as equity. Preference shares that are of many kinds have limited risk with a fair share of returns, thereby attracting investors. However, preference shares have both pros and cons, and hence you must evaluate them carefully before investing.

Use Tickertape Stock Screener to check the Dividend Per Share of a common share of a company.