In finance, the word “amortisation” is frequently used. Even if you have never heard of it, if you have an intangible asset or have taken out a loan, it undoubtedly applies to you.

Amortisation is an important concept to understand when it comes to mortgages or intangible assets. However, many individuals confuse depreciation with amortisation, but they are different.

Read on to know everything about amortisation, including how it works and the difference between depreciation and amortisation.

You will Learn About:

What is amortisation?

In reality, amortisation is applicable in two situations – intangible assets and loans.

What is amortised cost, many people ask?

For intangible assets, amortisation is the procedure of spreading out the asset’s cost (writing off) throughout its useful life. Patents, trademarks, copyrights etc., may qualify as intangible assets.

When it comes to loans, amortisation is the process of repaying a loan in full by the maturity date (by making monthly payments of principal and interest over a period). An amortisation schedule is calculated wherein part of repayment goes towards interest costs, and the remaining is used to cover the principal. Common amortised loans include car loans, mortgages etc.

A common question asked is – how to amortise goodwill/intangible assets? Usually, amortisation is charged as a straight-line expenditure. In other words, the same amount is expensed each month during the asset’s useful life.

Most of the time, assets expensed under the amortisation approach have no salvage or resale value. Remember, amortisation is considered a non-cash expenditure, meaning there is no actual cash outflow when they are recorded.

Return on equity: Highlights

- Amortisation is the method of writing off the value of an intangible asset, such as goodwill or a loan.

- The straight-line approach is the typical method for calculating amortisation.

- Though amortisation and depreciation have the same purpose, they are different concepts.

- Amortisation is crucial because it ensures that the cost of an item and the income it produces are equal.

- Lenders utilise amortisation schedules to show a loan payback schedule based on the exact maturity date.

Amortisation vs depreciation

Though amortisation and depreciation have the same purpose, they are conceptually different. Some of the significant differences between them are:

| Basis of Difference | Depreciation | Amortisation |

| Applicability | Depreciation spreads out the cost of a tangible asset, such as land, building, equipment, car, etc., over its useful life. | Amortisation spreads the cost of intangible assets, such as patents and trademarks, over their useful life. |

| Reason for reduced asset value | Depreciation illustrates how a fixed object/asset loses value over time. | Intangible assets lose value over time owing to things like contract expirations and obsolescence. |

| Accounting treatment | In depreciation, the asset’s value is not directly reduced, but a separate account called ‘accumulated depreciation’ is created. | When amortising an intangible asset, the account for that particular asset is immediately credited (decreased). |

| Salvage value | In depreciation, the physical asset can have a salvage/resale value at the end of its life. | Conversely, in the amortisation of assets, intangible assets have no salvage/resale value at the end of their life. |

| Method of calculation | Tangible assets can be depreciated using the written-down value method, straight-line method, etc. | Intangible assets are amortised using the straight-line method. |

Why is amortisation important?

Amortisation is significant for a lot of reasons.

- It first permits the progressive recognition of an intangible asset’s cost throughout its useful life. This is crucial because it guarantees that an asset’s cost will not be recognised all at once but throughout its useful life.

- Second, amortisation assists in balancing an asset’s cost and its revenue generation. It is vital since it ensures that the cost of an item and the income it produces are equal.

- Third, the amortisation process might enhance a company’s tax situation. During the asset’s useful life, the asset’s cost can be subtracted from taxable income.

- Amortisation schedules, when used in the context of loan repayment, make it clear how much of a loan payment is made up of the principal and interest, thus, helping claim interest payments as a tax deduction.

Amortisation of loans

Loan amortisation is the process of breaking a fixed-rate loan into equal payments. Each instalment includes a component for the interest and the principal.

Borrowers can compute the payments on loan amortisation using a loan amortisation calculator or table template. Lenders use the loan amortisation table to provide a summary of loan repayment to the borrower.

The amortisation table is very beneficial as it allows borrowers to assess how much debt they can afford and helps calculate their total yearly interest costs.

How to calculate amortisation?

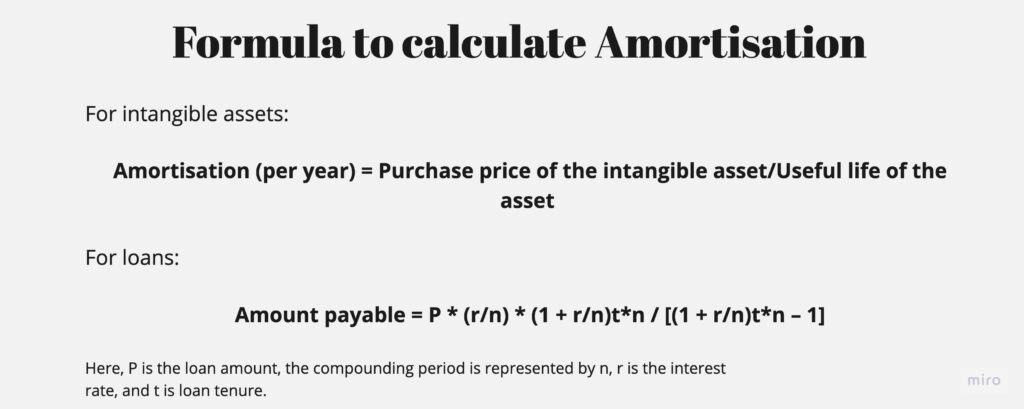

In accounting, the amortisation of an intangible asset can be calculated using the below formula:

Amortisation (per year) = Purchase price of the intangible asset/Useful life of the asset

Suppose a patent is purchased for Rs. 2,00,000, and its useful life is ten years.

The amortisation per year will be = 2,00,000/10 = Rs. 20,000.

In a loan, the amortisation formula is:

Amount payable = P * (r/n) * (1 + r/n)t*n / [(1 + r/n)t*n – 1]

Here, P is the loan amount, the compounding period is represented by n, r is the interest rate, and t is loan tenure.

Conclusion

Amortisation is gradually reducing debt/intangible assets’ value over a period. The exact cost of your borrowing or intangible assets may be calculated with the aid of amortisation. Confident cash flow estimates can be made possible by knowing how to calculate the amortisation of your assets and loans. It is often confused with depreciation, but it must be remembered that depreciation is strictly applicable to tangible assets only.