CAGR, or Compound Annual Growth Rate, gives a comprehensive view of the average growth rate of your investments over a certain period, assuming the gains are being reinvested each year. It helps calculate the increase or decrease in a specific metric over time.

Let us read in detail what CAGR is and its various nuances.

You will Learn About:

What is CAGR?

It is a compounded rate used for measuring the growth of investments over time. CAGR is also a geometric progression (GP) ratio, which helps measure the annual growth of investment during a specified period. It helps evaluate the performance of different financial and business metrics.

CAGR can be calculated using past trends and data. It can also be used to estimate future growth or decline in different financial and non-financial metrics. This helps in planning and strategising a company’s prospects.

Furthermore, CAGR can be used in different contexts. For example, CAGR is used in marketing to know the growth in sales, market demand, market share, etc. In a financial context, CAGR is used when talking about growth in bond prices, returns on investment, share prices, etc.

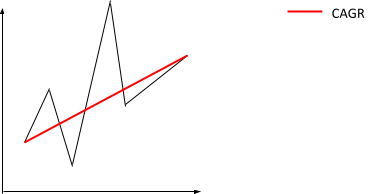

For example, the below graph shows the changes in the share price of a company over a period.

CAGR, i.e. the red line, depicts the price growth from the beginning to the end.

Return on equity: Highlights

- CAGR explains the annual growth or decline of various business elements, such as revenue, users, investments, etc., over a period of time

- CAGR can usually conceal the volatility in investments and give a more general view of the returns

- In order to calculate the CAGR, you need to determine the initial value, end value, and the number of years.

How to calculate CAGR?

The CAGR formula is as follows-

CAGR = (Vend / Vstart)1/n -1

where,

CAGR = Compound annual growth rate

Vend = Final value

Vstart = Beginning value

n = No. of years

For example, assume that a company has the following sales figures-

| Current | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | 10,000 | 12,000 | 14,000 | 16,000 | 18,000 | 20,000 |

CAGR = (20,000/10,000)1/5 -1

CAGR = 14.87%

Alternatively, you can use an online CAGR calculator to instantly determine your CAGR.

What does CAGR depict?

CAGR can depict multiple business elements.

CAGR becomes significant when it depicts a specific business metric, such as the CAGR of sales, market size, investments, etc.

For instance, the CAGR of mutual funds help in determining if the fund is giving expected returns, provided the gains are being reinvested each year. CAGR of investments help in comparing and evaluating different avenues of investments. CAGR of revenue helps determine a company’s performance over the years.

CAGR vs absolute returns

| CAGR | Absolute returns |

| CAGR is the annual growth rate of investments over a period of time. | Absolute return is the total return from an investment and depicts how much the investment has increased or decreased. |

| It is imperative to know the time period of investments to calculate CAGR. | Absolute returns do not consider the time period of investments. |

| CAGR conceals volatility in investments. | Absolute returns reflect volatility in investments. |

| It is a better metric to compare different investment avenues for a period of over one year. | It is a better metric to compare different investments for a year or less. This is because CAGR may exaggerate or reduce returns. |

| CAGR formula = (Vend / Vstart)1/n -1 | Absolute returns formula = (Current value-Initial value) / Initial Value *100 |

| For example-If an investment values Rs. 10,000 currently and values Rs. 30,000 at the end of 3 yrs, then the CAGR of this investment will be 44.22%. | For example-If your investment amount is Rs. 10,000 and the current value of investments is Rs. 30,000, then the absolute return is 300%. |

Limitations of CAGR

- CAGR ignores volatility and does not depict any risk. For example, the share prices of companies A, B and C are as follows –

| Current | Year 1 | Year 2 | Year 3 | |

| Share price of Company A | 1,000 | 9,000 | 10,000 | 4,000 |

| Share price of Company B | 1,000 | 500 | 800 | 4,000 |

| Share price of Company C | 1,000 | 2,000 | 3,000 | 4,000 |

The CAGR of share prices for all three companies is 58.74%. CAGR does not take into account the volatility of the share prices of the three companies. Here, CAGR wrongly assumes that the growth was uniform and steady. And thus, CAGR cannot measure the risk of investing in these companies.

- CAGR ignores the effect of the addition or withdrawal of funds by the investor. For example, the CAGR return will be inflated if an investor puts in additional funds. Similarly, when an investor withdraws a certain amount from the portfolio, the CAGR will be deflated. In both cases, CAGR will give inaccurate results.

- CAGR can be an inappropriate measure if the time frame is limited (due to certain abnormalities in the business environment or the difference between the actual CAGR and the estimated CAGR). This can lead to investors being negatively impacted.

Conclusion

The concept of CAGR is imperative in order to measure different business elements. It can be used to determine past trends and predict future returns. CAGR is also one of the most precise ways to calculate and evaluate investment portfolio returns, compare different investment avenues, forecast revenue, estimate share prices, etc.