You will Learn About:

What is NAV in mutual funds?

The Net Asset Value (NAV) in mutual funds is the per unit cost of the fund and represents the price at which the particular fund is bought or sold by an investor. A mutual fund’s NAV is decided by market forces at the end of the trading session and acts as a yardstick for measuring its market value.

NAV: What You Need to Know!

- NAV represents the market value per share for a specific mutual fund.

- NAV is calculated by dividing the net assets by the total number of mutual fund units issued.

- When investing in mutual funds, it is important to look for the performance history of the fund, not its NAV.

- A particular fund’s actual market value can differ from its NAV, which indicates a potential buying or selling opportunity.

What is the formula for NAV?

The NAV is generally represented on a per-share basis. The NAV formula when it comes to mutual funds is as below:

Here, the total value of assets is the market value of the mutual fund’s investment in addition to any accumulated income and receivables minus accrued expenses, unpaid debt to creditors, and other liabilities. This figure divided by the total number of mutual fund units issued or shares outstanding gives the net asset value of the mutual fund.

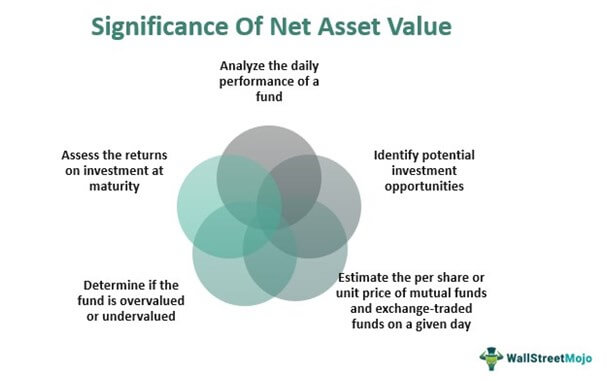

How is NAV relevant to investors?

It is possible that new investors mistake a NAV of Rs. 20 to be of higher worth than a NAV of Rs. 10 when choosing funds. This misunderstanding often arises from the fact that a mutual fund NAV functions the same way as the price of an equity share.

In simple terms, as an investor, you should not focus on how many units you own; rather, you should take note of how much your investment has appreciated in value or how the past performance of the fund has been. And NAV, as the measure of value, becomes the yardstick to compare funds on their historical performance and assess their growth.

Once you have picked your fund and invested in it, the amount of appreciation in the NAV becomes your profit when you decide to redeem the mutual fund units.

How is NAV calculated?

NAV calculation involves summing up the market value of all securities and subtracting the value of debts of the mutual fund. The value attained is then divided by the number of units outstanding. Give below is the NAV formula:

Here, the assets comprise cash in hand and securities. The latter includes equity, debt, or a combination of both. Any outstanding liabilities, like administrative expenses or salaries, are deducted to arrive at the current assets. This is then divided by the total number of outstanding shares to obtain the NAV.

You may also like our article on ‘Mutual Funds’. Visit the Tickertape blog now!

What is the difference between a NAV and a market price?

According to SEBI regulations, NAV can have two components: the value of assets and market price. While the value of assets stays constant till it gets sold off entirely, the market price fluctuates every second based on demand and supply. This difference is termed as net, in other words, net value.

Understanding the role of NAV in the performance of a Fund

NAV alone is not an indicator of a fund’s performance. Likewise, the myth that the higher the value of a mutual fund NAV, the better it is, does not hold true and cannot be a standalone parameter. However, what the NAV growth indicates is how the underlying assets have performed in a certain mutual fund and how the fund performs on an everyday basis.

Visit https://www.tickertape.in/screener/mutual-fund to learn more about mutual funds and to customise your search.

How does investment timing affect the NAV?

Mutual funds are bought and sold at the NAV. The cut-off timing for placing orders for buying and selling mutual funds units is 3 PM, as set by SEBI. However, the NAV for the day is set at the end of the trading session, after adjustments, at the close of the market session. Therefore, it is not necessary that the price or the NAV you observe when you place your order be the NAV at which your funds’ units are purchased.

Your transaction timing also influences the investment and NAV. In case of a failed transaction, the units do not get credited on the same day’s NAV but rather on the NAV decided at the market’s closing on the day the transaction is successful.

Similarly, when redeeming funds, you may place your order when you see the NAV at Rs. 20, for example, during mid-day. However, it is the closing NAV of the day that will become applicable for redemption. This may be Rs. 19 or Rs. 21 too.

How to estimate the returns from mutual funds?

Typically, investors seeking long-term investment options consider mutual funds, as it provides consistent growth and is less volatile. But, how can we calculate the returns attained on mutual funds?

There are many ways to estimate mutual fund returns, and these methods are applicable to both SIP and lump sum investments.

- Annual Return

The annual return rate allows you to assess the mutual fund’s performance during any given year of your investment.

Annual return = (Ending NAV – Beginning NAV) / Beginning NAV

- Absolute Return

This method is useful for calculating returns when the holding duration is 12 months or less.

Point-to-point return = [(Current NAV – Beginning NAV) / Beginning NAV] x 100

- Compounded Annual Growth Rate

If the period of investment is more than 1 year, CAGR is a good way to measure returns because it considers the time value of money.

CAGR = (Ending value / Beginning value)^1/n– 1

where n is the number of years.

- Extended Internal Rate of Return (XIRR) for SIPs

XIRR is the aggregate sum of multiple CAGRs for SIP investment. Herein, you regularly invest a certain amount to accumulate the maturity amount during investment closure. Depending on what the NAV of the SIP scheme is on the day you invest, you get a specific number of units that you have accumulated from day 1. On the day of the exit, you can redeem the total units and get the maturity.

Conclusion

The NAV is the price that an investor pays for investing in a mutual fund scheme. Investors can gauge the worth of their investments and ascertain how much the value of their investments has changed over time based on the fund’s NAV growth. There are many other factors that play a role when it comes to the decision-making process of investing in mutual funds. With this detailed guide about NAV, we are certain you will be able to make safer and smarter investment decisions.

FAQs

- What is good NAV value?

There is no particular value that can be ascribed to NAV being good or bad. Newer schemes are likely to have lower NAVs that are yet to realise their potential, while funds from established AMCs may have a higher market value that translates to higher NAVs. What matters is that there is consistent growth in NAVs over longer periods of time.

- What does low NAV indicate?

A low NAV may indicate a higher number of units in the market, or that the fund is relatively new or that there are few takers for it in the market. The absolute value of NAV cannot be used as a parameter to judge fund performance.

Let’s assume you invest Rs. 2000. It would get you 200 units with a NAV of Rs. 10, but only 100 units if the NAV is Rs. 20. Yet, in both scenarios, the worth of the investment is identical.

- What is negative NAV?

A negative NAV indicates the falling performance of a scheme. This is a rare case as the fund manager would likely switch out the underperformers in the portfolio and safeguard the value of the fund.

Admin Comment

badiya stuff bhai

Admin reply check

Replying to admin

Bhai 2nd comment