There is a plethora of mutual fund schemes available to investors. When the markets are performing well, most investors look for mutual fund investment opportunities to grow their portfolios. Asset management companies use this mindset to attract more investors.

New mutual fund schemes are often launched in the markets. But the question might arise: what is the procedure for establishing a new mutual fund scheme? The answer to this question is: via New Fund Offers (NFOs).

Let’s learn more about NFOs below.

What is NFO?

The term ‘NFO’ means ‘New Fund Offer’. An NFO is an introduction of a new mutual fund scheme launched by an AMC (Asset Management Company). Such an initial subscription-based NFO is issued to generate funds from the general public.

AMCs then invest such funds in marketable securities like shares, bonds, and so on.

Return on equity: Highlights

- A new fund offer (NFO) is the initial offering of fund units to investors by an AMC.

- NFOs, like stock market IPOs, are meant to raise funds which are then invested in securities like stocks etc.

- Investors can purchase either open-ended or closed-ended funds.

- Before investing in an NFO fund, consider market risk, fees, investment horizon, and more.

How NFO works?

New fund offers are extensively marketed and designed to encourage investors to purchase new units.

The SEBI (Securities and Exchange Board of India) has implemented laws and regulations governing the NFO process. It has laid down various guidelines, such as the amount that NFOs should accumulate throughout the NFO period and the scheme’s investment objective.

According to the rules and regulations, the minimum subscription amount for debt-oriented schemes and balanced hybrid funds at the time of an NFO must be at least Rs. 20 cr., and the minimum subscription amount for other schemes must be at least Rs. 10 cr.

Companies offer initial subscription offers for new funds for a limited time only. During this period, investors have the freedom to purchase them at a price decided by the company, which is also known as the offer price. The offer price established by the AMC or asset management company can be as low as Rs. 10 – Rs. 20 per unit.

After the NFO fund period ends, investors can purchase the same funds at the fund’s current net asset value (NAV). The cheaper the offer price, the greater the investment opportunity. An NFO is quite similar to an IPO (initial public offering), which is when a new stock first gets listed.

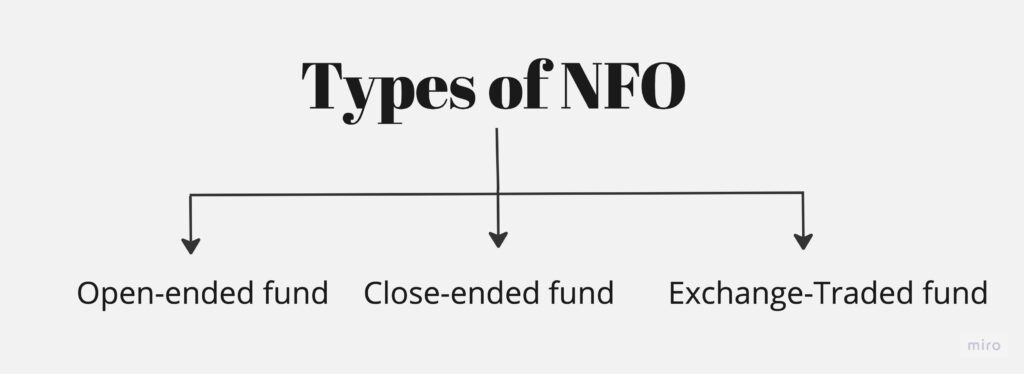

Types of NFOs

The most common types of new fund offers are:

- Open-ended fund

In this type of NFO, the business launches an offer for a new mutual fund whose units can be purchased even after the offer period has ended; hence they are called open-ended funds.

Once the scheme opens, you can choose to invest in NFO units. You can enter and exit the new mutual fund scheme at any time. When these funds are open for subscription, you can buy units for the lowest price or as decided by the company.

When the offer period ends, you can buy open-ended funds at the current market NAV (Net Asset Value). AMCs can also create new schemes with new strategies or add new units to the existing NFO scheme.

- Close-ended fund

In close-ended funds, only a limited number of units are launched by the AMC, which are only available for the specific offer period. After this subscription period ends, the investor will not be able to purchase any of the units that were launched during the NFO period.

Close-ended funds also have a maturity date; you can withdraw your investment after the expiration of the maturity date.

- ETF (Exchange-Traded Fund)

ETFs can be described as a bunch of securities (like stocks and bonds) that function like an investment fund and track an underlying index.

Exchange-traded funds (ETFs) also can be purchased through an NFO. Post the NFO, the units are listed and can be accessed directly.

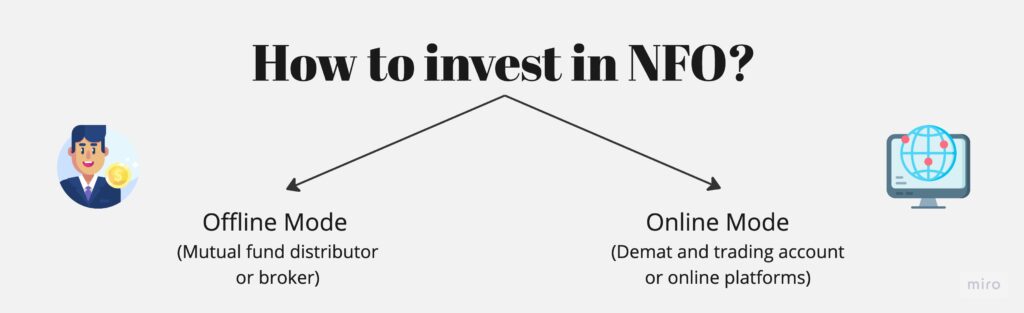

How to invest in NFO?

You can invest in an NFO fund through online or offline mode, depending on your preference:

- Offline mode

By using a mutual fund distributor or broker, you can buy some units launched during an NFO. The distributor or broker assists you in gathering the needed information and filling out the essential forms for the investment.

- Online mode

You can also choose to invest in NFOs online through your Demat and trading account or mutual fund platforms, which allow you to buy and sell units with just a few simple clicks. Online mode is more convenient and largely preferred.

Conclusion

One of the ways in which AMCs can launch new schemes is through a new fund offer or NFO. An NFO represents the opportunity to subscribe to a new mutual fund scheme for the first time. But before deciding to include this investment choice in your portfolio, you should do your due diligence about how NFO works. Make sure to consider AMC’s history, the past success of its fund managers, your risk tolerance, and the duration of your selected investment.

FAQs

What is the NFO fund?

A new fund offer (NFO) is the initial subscription offer for a new scheme offered by asset management firms (AMCs). A new fund offer is issued in the market to generate funds from the public, which are then invested in different securities.

What should I keep in mind before investing in NFOs?

Before investing in an NFO, you should investigate the fund house and the fund manager’s track record. You may also look at the performance of similar funds created by the fund company in the past. The better the fund house, the better your chances of making a profit.

Is there any benefit to applying through NFO?

The fund house uses an NFO to generate funds from the public in order to purchase market instruments such as equity shares, bonds, and so on. Because it is new to the market, units offered through an NFO can be less expensive than existing funds.