In today’s fast-paced and rapidly evolving business environment, many companies, particularly start-ups and small businesses, often find it difficult to hire and retain sufficiently qualified and skilled employees.

Many such companies are too small to have enough capital to meet the compensation expectations of experienced individuals. As a result, in lieu of a higher salary or other kinds of bonuses and perks, many such companies today are opting to offer Employee Stock Option Plans, or ESOPs, to their existing as well as potential employees.

You may also like to read about the difference between CTC and in-hand salary.

You will Learn About:

What is an Employee Stock Option Plan (ESOP)?

In the US, ESOP stands for ‘Employee Stock Ownership Plan’ and is technically a kind of contribution-based retirement plan. In the Indian context, however, the more accurate expansion for ESOP is the ‘Employee Stock Option Plan’.

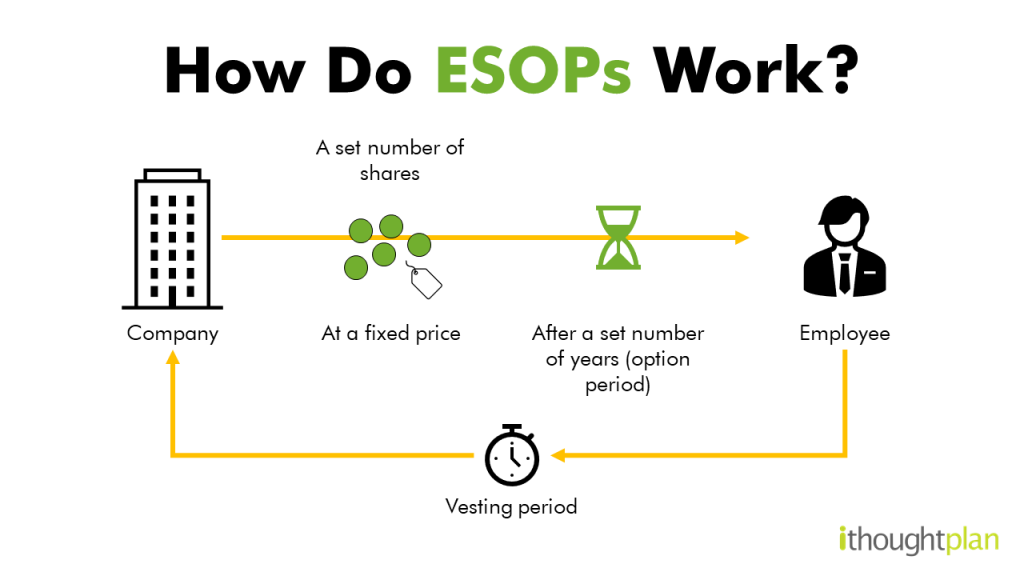

As the name suggests, an ESOP is a form of employee benefit plan that entitles employees to hold stock options in the company that employs them. These stock options give employees the right (but not the obligation) to purchase their employer’s shares at a predetermined price after a finite period of time (called the vesting period).

Relatively small companies or start-ups offer ESOPs as supplements to the base salary and various benefits and perks.

ESOP: What You Need to Know!

- ESOPs (Employee Stock Option Plans) enable employees to buy their employer’s shares at a predetermined price at the end of a certain period.

- ESOPs are allotted to employees through so-called ‘letters of grant’, which include details such as the number of shares the employees can buy, the price at which they can buy them, etc.

- A “vesting schedule” typically determines the points in time when employees can exercise the stock options obtained through an ESOP.

- ESOPs can generate huge amounts of wealth for employees if their employer becomes sufficiently successful.

How does an ESOP work?

A company may, at its own discretion, offer ESOPs to:

- Individual employees (to hire talent that might otherwise be unaffordable)

- A specific group of employees (middle management or senior management only)

- All of its employees

This is what the life cycle of an ESOP and the resulting stock options looks like, in a nutshell:

- A company drafts an ESOP plan and gets it approved by its shareholders.

- An ESOP may then be allocated to an employee through a ‘letter of grant’. Each letter of grant contains several key ESOP-related details, including the number of shares allotted to the employee, the vesting period, and the predetermined price at which the shares can be bought by the employee (known as the exercise price) etc.

- After the vesting period is over, employees gain the right to “exercise” their stock options, i.e. to buy the allotted number of company shares at the exercise price.

- Employees may then sell their shares back to the company (at a fair market value, which is based on the latest funding round or a recent company valuation) in the open market (if the company is public) or hold on to them with the expectation that they will grow in value.

Typically, if an employee leaves a company or is dismissed before their stock options have vested, then they lose the right to exercise them. It should also be noted that in practice, rather than there being a monolithic vesting period at the end of which all the stock options can be exercised, there is usually a vesting schedule that determines when stock options can be vested and to what extent.

For instance, a company might have a vesting schedule allowing its employees to exercise 25% of their stock options yearly. In such a situation, if an employee were to leave the company after 2 yrs and 8 months, they would lose 50% of their stock options.

If a company does well, and its valuation keeps rising, then employees with stock options might eventually get to buy company shares at a fraction of what they’re actually worth. By then selling the purchased shares, they can access high returns.

Why do companies offer ESOPs to their employees?

- Getting employees to have some skin in the game

In effect, ESOPs hold out the guarantee that employees with stock options will become part-owners of their organisation after a certain period of time. This aligns the incentives of such employees with the company’s goals and ensures that employees are interested in making sure that the company does well (since the company’s performance will directly affect the financial rewards they will get).

- Hiring top-notch talent for relatively low salaries

Companies constantly need skilled engineers, marketers, and managers to turn their ideas into actual success. However, many such companies can be cash-strapped and may not be able to hire the personnel they need simply by matching or exceeding their current salaries. Hence, they might use ESOPs to attract the talent they need.

- Retaining personnel

Given the high attrition rates in several sectors, such as IT, ESOPs may be used by such companies to retain their employees. A suitably long vesting schedule of 3-5 yrs can be a powerful motivator for employees, provided that the company grows consistently.

Advantages and drawbacks of ESOPs for employees

From the point of view of employees, the main advantage of ESOPs is that they can lead to massive wealth creation. Depending on how much a company grows, employees can get extremely high returns after exercising their stock options and selling the shares thus purchased.

For instance, when Flipkart decided to buy back a certain proportion of its employees’ stock options in 2021, several of its employees became millionaires.

However, there are also several downsides to ESOPs that employees should be mindful of. Some of these are:

- Lacklustre company growth

If a company fails to increase in value or goes bankrupt, an employee who accepted ESOPs will effectively lose money.

- A lack of monetisation avenues

Even if a company does well, and its stock grows in value, it might still be difficult for employees to encash their shares when they wish to.

- Double taxation

Currently, ESOP taxation in India works in such a way that employees end up paying tax on ESOPs twice. When ESOP-based stock options are first exercised, the difference between the exercise price and the fair market value is taxed as a prerequisite. Then, when an employee actually sells the shares purchased through the above-mentioned stock options, the sale attracts capital gains tax.

You may like to read more about how ESOPs are taxed.

Conclusion

An ESOP can be described as a form of employee benefit that may entitle employees to the shares of the company they work for at a pre-decided price and time period. Not all companies offer stock options. ESOPs can help attract and retain talent.