A company’s efficiency can be measured in many ways. One of the most popular metrics used is the working capital turnover ratio. This ratio signifies the rate of usage of the working capital against sales.

In this article, we will dive into the working capital turnover ratio, how to calculate it, and what it indicates.

What is the working capital turnover ratio?

The working capital turnover ratio measures the efficiency with which a company uses its assets to support sales and business growth.

Working capital points toward the relationship between the capital used for financing day-to-day operations and the results the company generates. The main components of this ratio are net sales, cost of goods sold, and working capital.

Understanding the working capital turnover ratio gives a company an idea of the money it has handy to spend on operations and essential payments once all the debt instalments and bills are paid.

Companies with higher working capital ratios are perceived to be efficient in generating sales and running operations. In that case, what does a negative working capital turnover ratio mean? It indicates that a company’s operational capacity is not too efficient.

All in all, a working capital turnover ratio is a great tool to measure a company’s financial and operational performance. It can also help to see if a company can pay off the debt in a stipulated period without falling short of funds in times of higher production requirements.

Working Capital Turnover Ratio: Quick Notes

- The working capital turnover ratio is also popularly known as net sales to working capital.

- The working capital turnover ratio determines how much sales a company generates against its working capital.

- The working capital turnover ratio can help understand a company’s operational efficiency.

- Companies with a higher working capital turnover ratio are more efficient in their operations and revenue generation.

How to calculate the working capital turnover ratio?

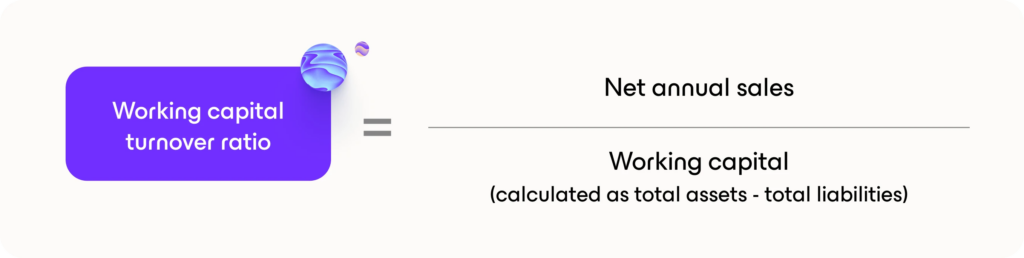

The formula for calculating the working capital turnover ratio is –

Working capital turnover ratio = Net sales/Working capital

Or

Working capital turnover ratio = Cost of goods sold/Working capital

Here,

Net sales = Gross revenue – Sales return – Discount – Allowances

For the management of any company, it is imperative to calculate the working capital turnover ratio, as it helps them ascertain the company’s ability to utilise its current funds in facilitating its turnover. For instance, a low working capital turnover ratio could imply lower sales than expected. Thus, the management can take necessary measures to improve its sales and enable growth and development.

Let’s understand this ratio with a simple example. Assume the following details of a company

Cost of goods sold – Rs. 20,00,000

Gross profit – 1/3rd of revenue from operations

Current assets – Rs. 10,00,000

Current liabilities – Rs. 1,00,000

The working capital turnover ratio would then be calculated as follows –

Net Sales = Cost of goods sold + Gross profit

X = Rs. 20,00,000 + X/3

X = Rs. 30,00,000

Working Capital = Current assets – Current liabilities

= Rs. 10,00,000 – Rs. 1,00,000

= Rs. 9,00,000

Working capital turnover ratio = Net sales/Working capital

= 30,00,000/9,00,000

= 3.34:1 or 3.34 times

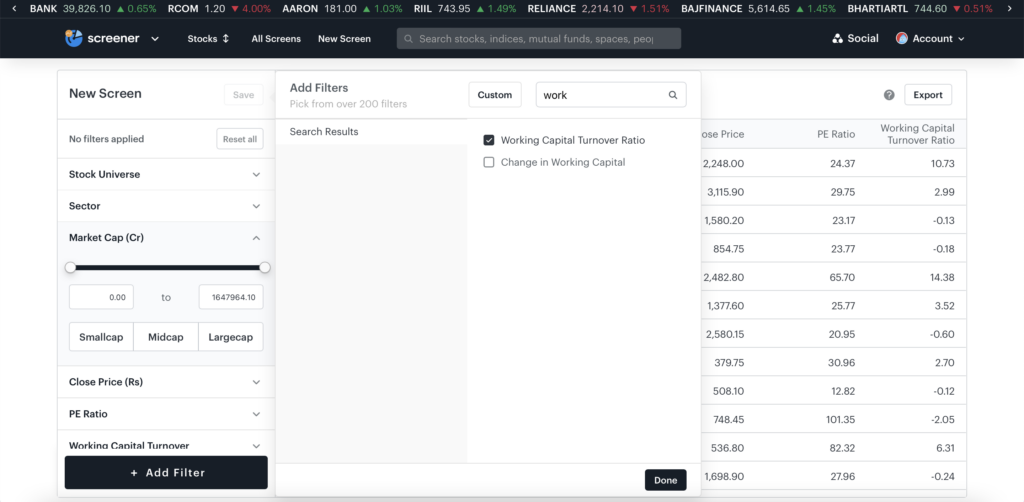

Use Tickertape Stock Screener to find the working capital turnover ratio of a stock. Open the Stock Screener, click on ‘Add Filter’ and search for ‘Working Capital Turnover Ratio’. Apart from this, there are 200+ filters that can help you in analysing a stock better.

What does the working capital turnover ratio indicate?

Calculating the working capital turnover ratio depicts how effectively a company employs its resources. The more sales a company makes, the higher profitability they register, which naturally helps boost the working capital turnover ratio.

Analysis of this ratio can enable companies to utilise their resources and working capital better. A low or negative working capital ratio means a company might be investing highly in inventory and accounts receivable to generate sales, which can lead to excessive obsolete inventory or bad debts.

Furthermore, working capital turnover is crucial for any business, especially small ventures, as it displays the relationship between the resources used to finance the company’s operations and its revenue.

The right way to leverage the working capital turnover ratio is by tracking how it has been fluctuating over time and comparing it with companies in the same industry. Using this approach, companies, stakeholders and investors can determine the true operational efficiency of a company.

Pros of working capital turnover ratio

There are several benefits of using a working capital turnover ratio, some of which include:

- Improves overall financial health

A working capital turnover ratio can help control the cash flow and analyse the inflow. A company’s overall financial health can be improved by efficiently identifying how to use cash profitably.

- Prevents operation interventions

By keeping the managers informed on the company’s working capital turnover ratio, funds can be utilised more efficiently, minimising disruptions.

- Helps move liquidity

When an organisation cannot maintain steady working capital, it may experience a slowdown. As the ratio helps analyse net sales and working capital requirements, the liquidity and profitability can easily be tracked. Corrective measures can then be undertaken to address liquidity gaps, if any.

Cons of working capital turnover ratio

- Focuses on monetary factors

A working capital turnover ratio only considers a company’s most prominent metrics like profitability, growth, liquidity, indebtedness, and stability. As important as these metrics are, non-financial factors like stakeholder diversity, quality of services, utilisation of resources, and management team also play a role in influencing a company’s financial health.

- A very high ratio can be deceiving

While having a high working capital turnover ratio is considered a positive sign, it may actually signify that a business does not have the sufficient cash flow to maintain its sales growth. A company must balance its working capital to sales ratio or find itself in a situation of insolvency.

Conclusion

The working capital turnover ratio measures the employment of working capital for the sales generated. A low ratio indicates inefficient utilisation of working capital over time and vice-versa. It is important that investors compare this ratio with the companies in the same sector and the industry average to truly understand a company’s standing.