Last Updated on Mar 24, 2021 by Manonmayi

Investing is quintessential to enjoy financial-freedom. That said, you find an array of attractive investments to park your funds when the economy is flourishing. But what happens when the economy hits a recession—stock markets plunge, fixed-income avenues offer a lower rate of interest and real estate depreciates? Does this mean you should refrain from investing? And that there are no avenues to invest during a recession? Well, not quiet. Read on to find out why

This article covers:

3 investments ideas during recession

Park your funds in real estate

Investment strategy during recession

Table of Contents

3 Investments ideas in recession

It is not easy to find a risk-free investment during recession. So, where could you possibly invest? Here we list 3 investment ideas in recession and why you could consider them.

Buy precious metals

Unlike stocks, precious metals tend to fare well during a financial crisis, making them safe investments during recession. Generally, gold and silver are known to hedge against recession. After losing a chunk of their wealth in stock markets, investors look to safeguard what remains and hence prefer shifting to safer options like metals.

Since the demand for these safe investments during recession increases, the prices follow suit. So, consider investing as per your affordability. Also, since holding physical gold is risky to store and carries additional expenses such as storage and labour charges, you may consider investing in Gold ETFs. This way you can avoid the associated expenses.

Park your funds in real estate

Just like most sectors of the economy, recession doesn’t spare the real estate sector either. The 2008 financial crisis is proof. Recession drains the value of housing and commercial properties by making them lacklustre. But there is a hidden opportunity here.

Well, think why did you want to invest in the first place? Wasn’t it to earn returns? Experts say real estate is one of the best investments during recession. Why you ask? Because, properties sell at low prices during recession. Therefore, seizing the opportunity now would reap sizeable benefits when the real estate sector recovers.

Stay invested in stocks

Stock markets hit rock bottom during an economic downturn, which may discourage you from buying stocks in a recession. But experts believe that a recession is a good time to buy/hold stocks with a long-term objective and not liquidate stock positions completely. There are a few sectors that thrive even during a recession and offer decent returns. So what sectors are these?

The ones that produce essentials. Think, would you go hungry or thirsty, and not avail medical treatment during a recession? Certainly not. There, you got the answer for which stocks to invest in during a recession. Scour for stocks in such sectors, evaluate and shortlist them, and pick the best one to invest.

Alternatively, you may also consider investing in dividend stocks during recession. The stocks of such companies offer high dividends, which can serve a passive income during your cash-strapped days. When evaluating dividend stocks during recession, consider companies that have a healthy balance sheet and a low debt-to-equity ratio.

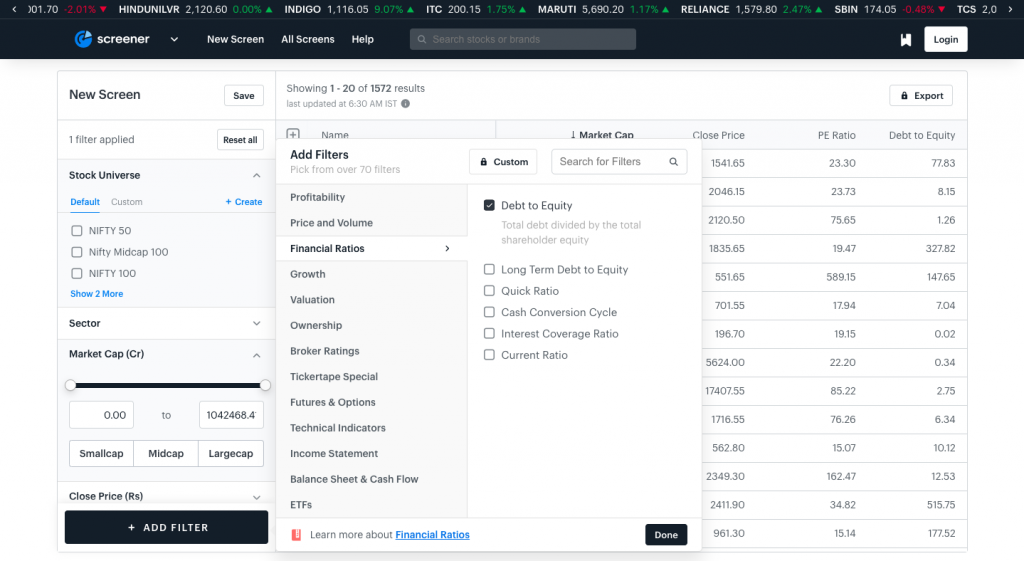

When buying stocks in a recession, you may use Tickertape stock screener to screen dividend-rich companies by applying the debt-to-equity ratio filter.

Once you shortlist stocks based on the filter, you can go the financials tab of the company and glance through the balance sheet.

Investment strategy during recession

Finally, a smart investment strategy during recession could be to hold on to your long-term investments and diversify your portfolio well. Consider consulting your financial advisor before investing in such an extraordinary time.

Let us know what you think of these investment ideas in recession in the comments below.

- List of Top Performing Index Funds in India (2025) - Apr 25, 2025

- Gilt Funds in India for 2025 – Meaning, Taxation, and More - Apr 21, 2025

- Alternative Investment Fund (AIF): Meaning and Category of Various AIFs - Apr 21, 2025