Last Updated on Apr 5, 2021 by Aradhana Gotur

Despite the government levying a heavy sin tax on cigarettes ?, the number of smokers is only on the rise.

The advertisement of a family-man Mukesh ? coughing his lungs out didn’t work either.

Furthermore, the words ‘TOBACCO CAUSES PAINFUL DEATH’ on a cigarette packet doesn’t seem to make a difference too. What do you do is read the warning and go on to smoke. After all, ignorance is bliss!

The chart below shows the increase in the number of male smokers between 1998 and 2015

But, what you don’t realise is that this ignorance comes with a significant cost.

No, we are not just pointing out at the money you spend on cigarettes - it will have cost you a fortune on consolidating the amount you spent so far on - we are also speaking about health insurance.

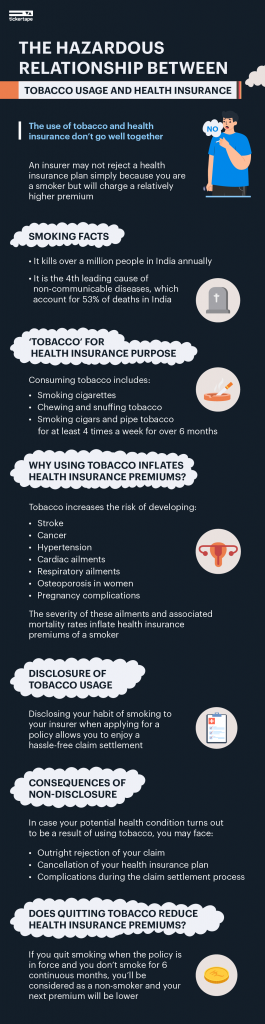

Truth hurts but the use of tobacco and health insurance don’t go well together. Why, you wonder? We will elaborate.

Table of Contents

But first, some statistics to blow your mind ?️

- About 34.6% of adults in India are smokers, out of which 47.9% are men and 20.3% are women

- While 14% of adults consume tobacco in the form of smoke, 25.9% use it in a smokeless form

So, does this mean users of tobacco can’t have health insurance? ? No. As per IRDAI guidelines, an insurer may not reject a health insurance plan simply because you are a smoker. If you have any knowledge about personal finance, and insurance, in particular, you will know that insurers charge a higher health insurance premium ?to smokers when compared to non-smokers. Nevertheless, they can make an exception and can deny you a health insurance policy in case you seem to develop severe health conditions or complications due to heavy smoking in the near future.

Wonder why? Here are some insights.

The purview of ‘tobacco’ for health insurance purpose

In the context of insurance, consuming tobacco is not limited to smoking cigarettes. It also includes:

- Chewing and snuffing tobacco and

- Smoking cigars and pipe tobacco

for at least 4 times in a week and have continued doing so for over 6 months.

Why does using tobacco translate into higher health insurance premiums?

It is no secret that using tobacco, smoking, in particular, is dangerous to your financial health given the high costs that it entails. Nonetheless, tobacco is no good for your physical health either as it increases the risk of developing severe health issues such as:

- Stroke

- Hypertension

- Cardiac ailments

- Cancer

- Respiratory ailments

- Pregnancy complications

- Osteoporosis in women

Coming to the point, the severity of these ailments and the associated mortality rates force insurers to charge higher premiums to a smoker.

Still, there are some insurers who don’t distinguish between a smoker and a non-smoker and charge the same premium to both. However, to apply for a health plan with such an insurer, you shouldn’t be suffering from any severe health complications.

Disclosure of tobacco usage to your health insurer

Though not mandatory, informing your insurer about your smoking habit when applying for a policy helps. Doing this allows you to enjoy a hassle-free claim settlement in case a situation arises where you have to use your health insurance.

Consequences of non-disclosure of tobacco usage

If you think you can get away with high premiums by not disclosing your smoking habit to the insurer, then you are not right. Owing to increasing frauds, insurers have learnt their lesson and so strictly investigate tobacco usage when processing your application and settling your claim by conducting a medical check-up. If your blood and urine has traces of nicotine, then it establishes that you are a smoker. But most insurers only conduct a health check-up in case you are aged over 40 years or request for a high sum insured. Still, submitting a self-declaration is always the best bet.

In case you don’t disclose your habit of smoking when applying for insurance and your respective health condition turns out to be a result of tobacco, you must be ready to face severe consequences such as:

- Complications during the claim settlement process

- Outright rejection of your claim

- Cancellation of your health insurance plan

Thus, disclosing your smoking habit, whether occasional or regular, to your insurer at the time of applying for the policy is always a good idea. Although you may have to shell out a high premium, an honest disclosure will at least dodge cancellation of your policy or rejection of your claim if the insurer finds out.

What happens to health insurance premiums when you quit smoking?

The good news is that if you quit smoking when the policy is still in force and don’t smoke for 6 continuous months, your insurer will consider you as a non-smoker. And so, your next premium will be lower as it will be calculated based on the terms and conditions applicable to a non-smoker.

Folks, you have two options to safeguard your finances: either quit consuming tobacco (and spare your health too) or disclose your habit to the insurer (talk about being honest at every step ?). And not disclosing it isn’t a great idea!

- Gilt Funds in India: Features, Meaning, and Advantages - Mar 13, 2025

- Large Cap Funds (2025): Top Blue Chip Funds List - Mar 13, 2025

- Best Index Funds in India 2025: Top Performing Mutual Funds - Mar 13, 2025