Know what’s the sentiment on the street today

Market Mood Index

Updated 1 hour ago

MMI is in the extreme fear zone. Extreme fear (<30) suggests a good time to open fresh positions, as markets are likely to be oversold and might turn upwards.

See all Zones

Change in MMI vs NIFTY since

MMI changed from

Fear

Fear

36.10

Ext. Fear

Extreme Fear

28.54

NIFTY returned

2.23%

-533.55

Unlock full history with Tickertape Pro

MMI helps you time your trades and investments better

It is a sentiment tool that describes the current mood in the market as emotions

Be fearful when others are greedy & greedy when others are fearful

- Warren Buffett

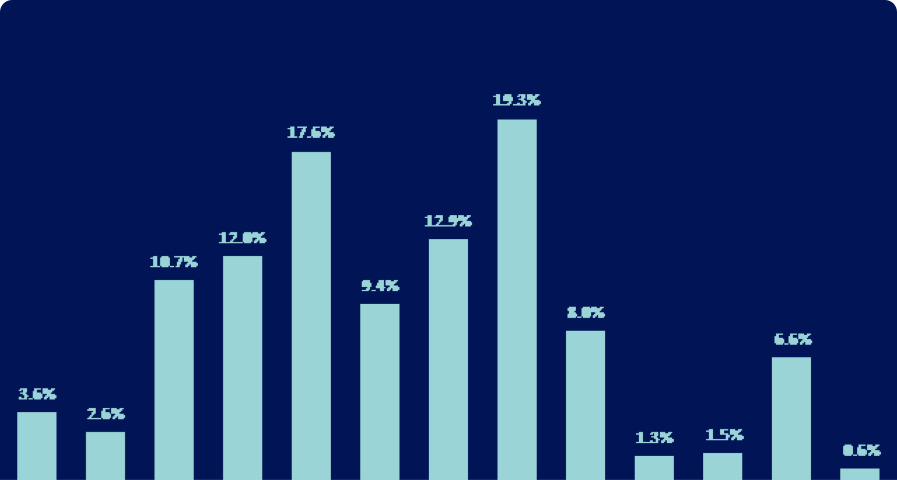

We have rigorously tested MMI and it is 91.28% accurate

Historical observation says that when the MMI reaches extreme fear zone, the market bottoms out & when the MMI reaches extreme greed zone, the market tops out

History of Nifty vs MMI View Full Image

How is the MMI built?

The Market Mood Index takes into account 6 important factors to give a complete picture of emotions driving the market

FII Activity

This is the net open interest of FIIs in Index Futures on the NSE. Tracking movement in this indicator gives an insight into FII views about the markets.

Higher than average value suggests bullish FII views about the markets.

Read More →Volatility and Skew

Volatility is measured by the India VIX index. It is the implied volatility of 1 month Nifty 50 options. Skew is calculated as the difference between implied volatilities (IV) of OTM put options and OTM call options of NIfty 50.

High VIX value suggests that market participants are expecting increased risk and volatility in the market. Volatility only tells us that the markets are expecting some movement, but doesn’t tell us anything about the direction. This is done using Skew - a higher than average value of skew represents a high chance of downward movement and vice versa.

Read More →Momentum

It is the difference between 90D & 30D exponential moving averages of Nifty 50, divided by 90D moving average.

A positive value indicates an uptrend and vice versa.

Read More →Market Breadth

It is calculated by dividing AD Ratio by AD Volume - also known as Modified Arms Index

A relative low value (<1) indicates strong market movement supported by volumes.

Read More →Price Strength

It is calculated by subtracting % of stocks near their 52W low from % of stocks near their 52W high to arrive at the net % of stocks near their 52W high.

Higher value indicates better price strength in the market.

Read More →Demand for Gold

It is the relative price return of Gold vs Nifty 50 for last 2 weeks.

If the return of gold is increasing relative to Nifty 50, it indicates a movement away from equities into safer commodities like Gold.

Read More →The final indicator value is calculated by giving equal weight to each of the components

See how you can build investing & trading strategies with the MMI

Don’t take our word for it

Over 100k+ investors trust MMI to time the market better

ET NOW - Tickertape MMI (Market Mood Index) surges to highest since launch - shows extreme greed on the street

#MarketMoodIndex of the day - an indicator that identifies the emotions in the market and gets you a sense of factors at play.

For investors who are unsure of how the market sentiment looks like, use this! @TickertapeIN #theaverageinvestor

@ETNOWlive #MarketMoodIndex: Buy during extreme fear!

https://tickertape.in/market-mood-index

We are almost there!

MMI is a great indicator to understand overbought, oversold zones and overall market sentiments. Great tool @TickertapeIN @vasanthkamath @anugrah_shrivas

Another neat tool from @TickertapeIN

Another reason to love @TickertapeIN , Nice stuff @vasanthkamath @anugrah_shrivas

MMI is pretty cool indeed, especially the various factors it includes. Can be used even by advisors as a tool (with a pinch of salt)

Frequently Asked Questions

Is it a good time to invest in the equity market?

There is no way to predict good entry and exit times in the market with absolute accuracy. However, MMI provides a sound starting point of indication backed by exhaustive testing. The current indication is that the market is in the Extreme Fear zone.

How is it different from the India VIX index?

India VIX is a volatility index which measures market expectations of near term volatility. On the other hand, MMI is a more comprehensive indicator of market sentiment, wherein VIX is only 1 of 7 components

Can Indian stock market investors benefit out of MMI?

Individual investors can use the MMI as a tool to gauge how the overall market is currently behaving - has it gone on a buying spree and possibly headed towards a bubble, or are investors fearful of the current market environment & selling more than they do in normal conditions

Can MMI be used for equity market predictions?

MMI is a sentiment index and investors shouldn’t take buy/sell decisions, just based on the current value. But once an investor has decided to invest or close existing positions, the MMI can help them better time the market.

Disclaimer

MMI is a sentiment tool provided for informational purposes only and should not be considered as financial advice. The MMI utilises specific parameters to gauge market sentiments, but it does not guarantee the accuracy or reliability of any investment decisions made based on its readings. Users are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

The logic for MMI is provided by Windmill Capital Private Limited (WCPL), a SEBI-registered Research Analyst having registration number - INH200007645. WCPL is also a wholly owned subsidiary of Smallcase Technologies Pvt Ltd (parent company of Anchorage Technologies Private Limited)